GST News

Finance Bill 2026 to Propose Fast-Track GST Registration, 90% Auto Refunds for Businesses

10 November 2025 at 06:32The upcoming Finance Bill 2026 is set to introduce major GST amendments, including fast-track registration within three days and automatic 90% refunds under the inverted duty structure.

LIC Passes On Full GST Exemption Benefit to Policyholder: Net Profit Rises to Rs 10,053 Crore

10 November 2025 at 06:32LIC CEO announced that the insurer has fully passed on the GST 2.0 exemption benefits to policyholders, making life insurance more affordable.

Auto Retail Sales Surge 40.5% in October, Led by Rural Demand and Tax Relief Under GST 2.0

10 November 2025 at 06:32India’s automobile retail industry achieved a record 40.5% YoY growth in October 2025, driven by GST 2.0 tax cuts, festive demand, and rural recovery.

GST 2.0 Impact: Insurers Slash Agent Commissions as ITC Withdrawal Raises Costs

08 November 2025 at 06:31Insurance agents have approached the Finance Ministry and GST Council after insurers reduced commissions due to loss of input tax credit under GST 2.0. Officials say the matter is a commercial one between insurers and agents, not a GST policy issue.

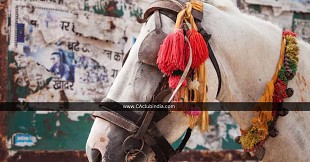

GST Team Monitors Horse Sales at Pushkar Fair as 5% Tax Applies for the First Time on Transactions Above Rs 40 Lakh

07 November 2025 at 06:32For the first time, GST officials monitored horse sales at Rajasthan's Pushkar Fair, applying 5% GST on transactions above Rs 40 lakh. Authorities said no horse has sold beyond Rs 10 lakh despite viral social media claims.

Two Women Booked for Rs 2.56 Crore GST Evasion by Creating Fake Firm in Lucknow

07 November 2025 at 06:32Two women traders in Lucknow have been booked for evading Rs 2.56 crore in GST by creating a fake firm, Gorupan Enterprises. The State Tax Department discovered the firm's address and contact details to be bogus.

20 States Report Dip in GST Collections in October Amid Transition to GST 2.0 Rate Structure

06 November 2025 at 06:46GST collections slowed to 4.6% in October as 20 states saw declines, reflecting transition effects from the new GST 2.0 rate reform introduced in September.

CBIC Clarifies GST Registration Requirement for Importers Storing Goods in Warehouses Outside Their Home State

06 November 2025 at 06:46CBIC clarifies that businesses storing goods in warehouses located in other States must obtain separate GST registration. The clarification outlines GST liability, invoicing, place of supply and compliance requirements under the CGST and IGST Acts.

CBI Books CGST Assistant Commissioner in Jaipur for Rs 2.54 Crore Disproportionate Assets

04 November 2025 at 06:33The CBI has booked a CGST Assistant Commissioner from Jaipur for allegedly possessing assets worth Rs 2.54 crore, 100% beyond known income sources.

Gross GST Revenue Rises 4.6% YoY to Rs 1.96 Lakh Crore in October 2025

03 November 2025 at 06:26India's gross GST revenue rose 4.6% year-on-year to Rs 1.96 lakh crore in October 2025, driven by strong import collections and higher compliance. Cumulative FY26 GST collections up 9% to Rs 13.89 lakh crore.

Popular News

- ICAI Introduces UDIN Ceiling & Field-Level Validation for Section 44AB Tax Audits from 1st April 2026

- Draft Form 124 Proposes Mandatory Disclosure of Relationship With Landlord for HRA Claims

- ICAI: UDIN Validation Now Based on Five Parameters Including PAN

- MCA Launches Companies Compliance Facilitation Scheme 2026 with Major Relief on Late Filing Fees

- New Draft Form Introduced for Provisional Registration Under Income Tax Act, 2025

Trending Online Classes

-

DT & Audit (Exam Oriented Fastrack Batch) - For May 26 Exams and onwards Full English

CA Bhanwar Borana & CA Shubham Keswani

CA Bhanwar Borana & CA Shubham Keswani -

IDT LIVE Exam Oriented Batch | May 2026, Sept 2026 & Jan 2027

CA Arpita Tulsyan

CA Arpita Tulsyan

CAclubindia

CAclubindia