Menu

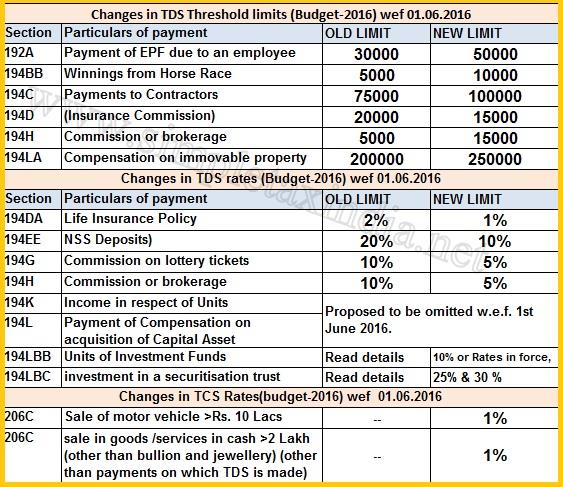

Tcs 1%

hello

I would like to know is there any new amendment applicable from 01.06.2016 of TCS 1% should be deducted on payment received in cash on sale of goods/provision of any services*xceeding Rs.2 Lac?

If Yes, how is the Tax deducted and how is this paid to Government.

what is cash is received in bank more then 2 Lacs? will TCS be deducted?

Replies (3)

Recent Threads

- 40+ single CA group

- Interest u/s 234B on updated return u/s 139(8A)

- GST registration documents

- Goods Return of FY 24-25

- Compliance Notice under section 80G

- Income Tax refund not even processed after 5 month

- Interest on Tds of professional charges

- Notice on foreign assets

- How much cash deposit allowed in bank for loan rep

- Income Tax Compliance Notice for Donation

Related Threads

CAclubindia

CAclubindia