Tax Treatment of Pension ,Commuted pension under Income Tax Act

- Tax treatment of Pension

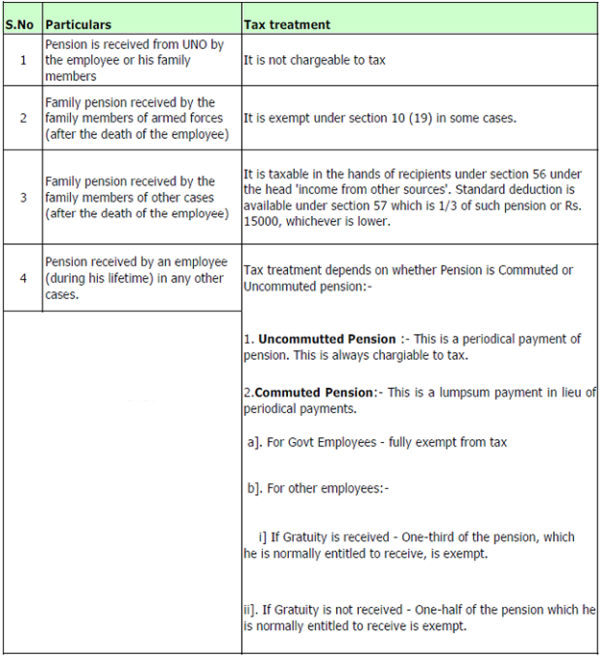

Pension is a retirement benefit. Since this is payable to an employee or to his dependents by virtue of past employment, this is taxed as salary in the hands of the employee. Tax is deductible on pension income under section 192 of Income Tax act on payment.

However, family pension received by the dependents of the employee will be taxed under the head income from other sources as there is no employer employee relationship between the payer and payee. TDS is not deductible on family pension as it is not covered under section 192 of the Income tax act.

The provisions under Income Tax are enumerated below:-

Example: 1 Mr. X retires from Govt service as on May 31, 2012. He gets pension of Rs. 15,000 per month up to December 31, 2012. With effect from January 1, 2013, he gets One third of his pension commuted for Rs. 10,00,000 . He is not in receipt of Gratuity.

Solution:- Uncommuted pension [periodical payments] is always chargeable to tax. Commuted pension is exempt from tax in the case of Government Employees. Therefore, commuted pension of Rs. 10,00,000/- is exempt. The amount of taxable uncommuted pension is calculated as under:

Uncommuted pension June 1 to Dec 31, 2012 = Rs.1, 05,000/- [i.e. Rs. 15000 x 7].

Uncommuted pension Jan 2013 to March 2013 = Rs. 30,000/- [Rs. 15,000 x 2/3 x 3].

Total amount of uncommuted pension chargeable to tax = 1, 35,000 /-

Example: 2 Mr. X retires from ABC Ltd as on June 30, 2012. He gets pension of Rs. 20,000 per month up to Jan 31, 2013. With effect from Feb 1, 2013, he gets 60% of pension commuted for Rs. 10,00,000/-. He also received Gratuity of Rs. 50,000/- up on his retirement.

Solution:-

A]. Uncommuted Pension:-

July 2012 to Jan 2013 @ Rs. 20,000/ Month = 1,40,000/-

Feb 2013 to March 2013 @ Rs. 20,000/ Month x 40% = 16,000/-

[Since 60% is commuted, only remaining 40% will be received monthly].

Total amount of uncommuted pension for the year 12-13 = 1,56,000/- [ 1,40,000 + 16,000]

B]. Commuted Pension :-

Amount of commuted Pension = Rs.10,00,000/- [ being 60%]

Therefore full value of commuted pension = 10,00,000 / .6 = 16,66,667/-

As Mr. X receives gratuity, 1/3 of full value of commuted pension is exempt from tax ie; 16,66,667 X 1/3 = 5,55,556 is exempt from tax, hence the taxable amount of commuted pension = commuted pension received minus pension exempted Ie; 10,00,000- 5,55,556 = 4,44,444 is taxable

C]. Total amount of taxable pension for the p/y 2012-13 = 1, 56,000 + 4, 44,444 = 6,00,444 /-

Attached File : 423578 1254243 tax on pension.pdf downloaded: 2060 times

CAclubindia

CAclubindia