From the Unit - ISSUE, FORFEITURE, REISSUE OF SHARES

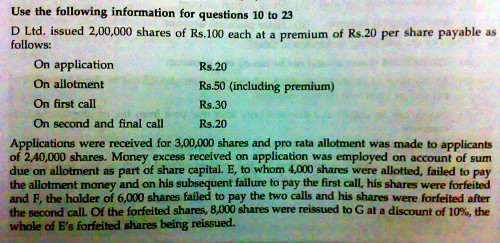

Not getting text book answers....

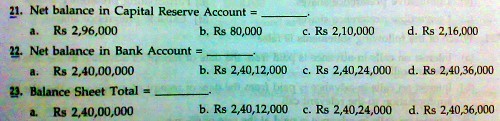

Not getting the textbook answers for the following quesions:

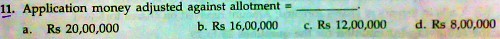

Textbook answer is (b),

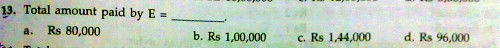

Tb answers is (d),

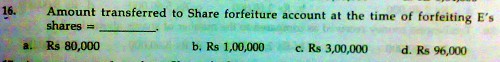

Tb answer is (d),

Textbook answer is (d), (d) & (d).

Pls explain how......

Thnx,

rat65

This question is very lengthy... Anyway I will try to answer in best possible manner. Kindly read each line very carefully.

Answers----

11- The answer to this question is wrong in textbook. Correct answer is INR 800000. This is the amount which will be adjusted against allotment. There is pro rata allotment of 240000 shares. It means the excess is on 40000 shares (240000 – 200000) so, 40000 shares into Rs 20 will be 800000. Balance Rs1200000 (60000shares*20) is refunded back…

13- What E has paid?

Application money only. Also at the time of application he applied for 4800 shares (4000 allotted). How 4800 shares? 4000 shares * total applied shares/ total allotted shares.

Hence 4000 *240000/200000 = 4800 shares applied.

The excess money on 800 shares applied is adjusted in allotment. So, he has paid in all as per question is 4800 shares * 20 = INR 96000.

16- Since E has paid in total Rs 96000 before allotment. After that (up to 1st call) he has not paid anything. Hence this is the amount which will be forfeited. So it’s INR96000.

21- Here shares reissued are 8000 shares. It contains total of 4000 shares forfeited of E and 4000 shares of F.

Amount of forfeited amount on E’s share= 96000

Amount of forfeited amount on F’s share = 300000(see case 17). This is on 6000 shares. So the amount forfeited on 4000 shares reissued shares is 300000/6000shares*4000 shares = 200000

Total amount forfeited in terms of reissued shares INR 296000

There is also a reissue discount of Rs 40000 on 4000 shares reissued of E’s share. Then there is reissue discount of Rs 40000 on 4000 shares reissued of F’s share. So total reissue discount is Rs 80000.

Hence net balance of Capital Reserve A/c = 296000 – 80000

= INR 216000

22- For net balance in Bank A/c, see the workings below---

|

Particulars |

Bank Balance |

|

|

|

|

Application money recd. (300000*20) |

6000000 |

|

Refund of Rs 1200000( 60000*20) |

4800000(60 lkhs - 12 lkhs) |

|

Allotment money Recd. - Due amount after adjustment of excess money - Rs 920000(10000000 – 800000) -Less amount unpaid by E ( 4000*50 -16000) This 16000 is adjustment of excess money on application 800shares*20 = INR 184000 |

13816000 (4800000 + 9016000 |

|

1st call money Recd. - Due amount Rs 6000000(2lkhs shares *30) - Less not recd 300000 (10000 shares *30) |

19516000 (13816000 + 5700000) |

|

2nd call money recd. - Due amount Rs3920000( 196000 * 20) - Less not recd Rs 120000 ( 6000 * 20) |

23316000 (19516000 + 3800000) |

|

Recd on reissued shares( 8000*90) |

24036000 ( 23316000 + 720000) |

Hence Net balance of Bank Is INR 24036000/=

23-- Since you know Balance sheet tallies on both sides. Here we have got bank balance and there are no other items on Asset side, so the total of Asset will be INR 24036000/=

Hence balance sheet total will be also INR 24036000/=

Hope you have understood.. If not, ask again without hesitation..

Thought no one would answer bcoz of the length....But excellent explanation.....thank you...........

4800 shares....this was the key to all of the above....

But let me ask you - just like how we got 4800 shares applied for by E, the same way F must have applied for 7200 shares (6000*240000/200000), na?

(E was allotted and F was holder, is that it?

yes F's calculation are also like that. He has applied for 7200 shares.

ok...got it.....Thnx.... ;D

Some more simple questions ....Pls help....

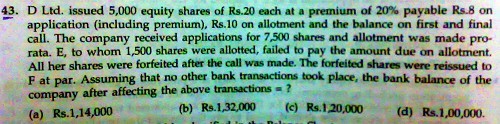

The TB answer is (b), but I'm getting Rs.1,82,000.

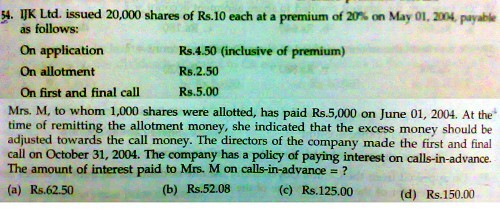

The answeris (a) but I'm getting totally diff answer - Rs.12.5....??

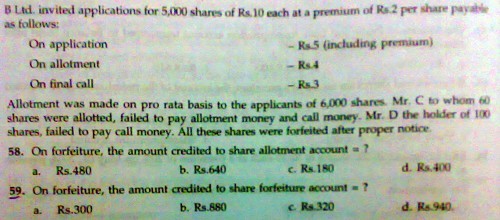

59 nth one.....I'm getting (b), but TB ans is (d)...which is correct?

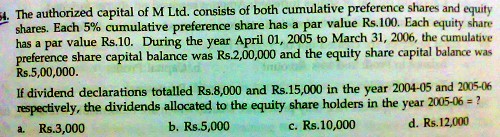

The answer is (a) but what is the theory....can't find in TB....

Thnx in advance,

rat65

Dear…… (What’s your real name yaar?)

Before answering, I would like to say that in such questions you should visualize journal entries and then proceed step by step. This will fine tune your conceptual understanding.

Answers---

43---

|

Particulars |

Bank Balance |

|

|

|

|

Application money recd. (7500* 8) |

60000 |

|

Allotment money recd. - Due after adjustment of excess money from application(5000*10 – 20000 rs)= 30000 - Less unpaid by E (15000 – 6000 from appl) =9000 ** Excess money from E Shares applied 2250(1500*7500/5000). Rs(2250*8 – 1500*8) |

81000 (60000 + 21000) |

|

Call money recd. - Due on call = 30000 (5000*6) - Less unpaid by E = 9000(1500*6) |

102000 (81000 +21000) |

|

After forfeiture , shares are reissued at par - Reissued money recd. (1500 * 20) |

132000 (10200 + 30000) |

54--

Excess money paid byMrs.M on allotment June 1st, 2004 = Rs (5000 – 1000*2.50)

= Rs 2500

Call was due on October 31st, 2004

So excess money was in the hands of company for 5months (June – October)

As per Table A this money which was received is calls in advance and will be allowed interest @ 6% p.a.

So, Interest paid to Mrs. M = Rs 2500 * 6%*5/12

= Rs 62.50

59---

Here the amount that goes to share forfeiture amount is the amount paid by C and D.

One more thing remember that securities premium is not forfeited as it belongs to Co. and not to particular shareholder. Shareholder cannot claim any right over securities premium amount paid by him.

In this question amount paid byC is only application money. He had applied for 72 shares (60*6000/5000). So he paid Rs 360(72* 5). Excess money is used in part satisfaction of allotment money.

Now D paid in total up to allotment money. So he paid Rs 900(100*9)

Total amount recd from C and D = Rs 1260 (360 + 900)

As i said you should exclude securities premium as above, which will be Rs 320(160 shares * 2)

Hence Share forfeiture account will have Rs 940(1260- 320)

64—

The theory relating to this is given in material under Types of preference shares.

Cumulative preference shares are those shares on which the right of arrears of dividend of previous years keeps getting accumulated unless it is paid by the Co.

In this question the declaration of dividend in 2004-05 was Rs 8000. Cum. Pref shareholders were to be paid dividend of Rs 10000 (200000 * 5%). So they accumulated Rs 2000 as arrears of dividend for 2004-05.

In 2005-06 dividend declaration was Rs 15000. Cum. Pref shareholders were to be paid Rs 10000 as dividend + arrears of 2004-05. So the amount left after payment to Cum. Pref shareholders was Rs 3000(15000 – 10000 -2000). This amount of Rs 3000 was allocated to equity shareholders in the year 2005 – 06.

One thing more dividend payment order is first to preference shareholders and then to equity shareholders.

Hope you have understood…

Knew you'd be the only one replying for such questions requiring a bit lengthy explanations for easy understanding........:) Thnx a miilion again......Name's Sarat btw.....For 54 th one I thought Rs.5000 paid was application money and excess (Mrs.M), so didn't get the answer....

Cheers,

rat65

Your are not logged in . Please login to post replies

Click here to Login / Register

CAclubindia

CAclubindia

India's largest network for

finance professionals