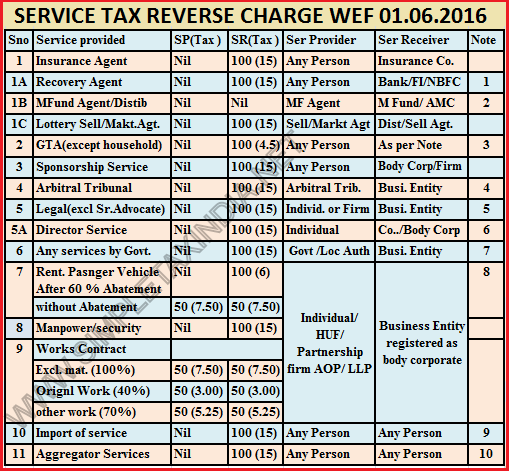

An unregistered person has given his property on rent to a nationalised bank. whether the bank has to pay Gst on such rent as per reverse charge under Gst. If yes, From which date this provision came in to force. What was the situation before Gst (under sevice tax law) in this case.

Menu

Reverse charge on renting of immovable property to a bank

Replies (6)

Recent Threads

- Are AI tools like ChatGPT actually useful for CA w

- UK TAX (HMRC) HELP WITH INVESTIGATIONS, DISPUTES,

- Payment processor not transferring or refunding pa

- Form 16 format

- 17(5) Blocked ITC

- Transfer of equity shares to original owner

- Login credentials and payment acknowledgement not

- Export sales not realised payment not received fro

- Capital gain account amount utilisation

- Form 26QB – Section 194-IA: TDS on Full Cons

Related Threads

CAclubindia

CAclubindia