SEO Sai Gr. Hosp.

210838 Points

Joined July 2016

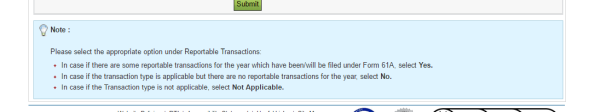

" In compliance by selecting in STF 13, Not applicable option we can submitted,without generating ITDREIN i think."

No; that will be mis-reporting under law. Rather than that you may not report at all, that may not attract any penalty (at first stage, because no reportable trasaction), but mis-reporting can attract penalty.