Here is ready-reckoner I came across.

Menu

Forum Search

Person not made cash sale of Rs 2 lac has to submit 61A?

fROM TODAY u can file option NO in preliminary response without generating ITDREIN

Now submit NO without generating ITDREIN in preliminary response sheet

No needed anymore to generate ITDREIN for option NO under preliminary response

I have a question that if there are 11 sales invoices of 20,000/- each to ONE PERSON IE SALES RS.2.20 lacs and i have received cash against each of them SEPERATELY ON DIFFERENT DATES then is SFT-13 applicable if a person is covered u/s 44AB

Since there has been some changes recently ... so i checked my old response and now i can see NIL TRANSACTION in SFT 013, where i had selected NO while filing..

So the Selection NO is replaces by NIL TRANSACTION.

Maybe some more changes expected :) and extention of the Due date too ;)

| Originally posted by : nidhi | ||

|

I have a question that if there are 11 sales invoices of 20,000/- each to ONE PERSON IE SALES RS.2.20 lacs and i have received cash against each of them SEPERATELY ON DIFFERENT DATES then is SFT-13 applicable if a person is covered u/s 44AB |  |

Theoretically Not applicable. But if all the 10/11 sales invoice are of same date, then that may create trouble.

New Changes in perliminary response

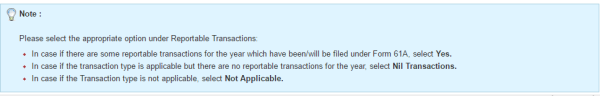

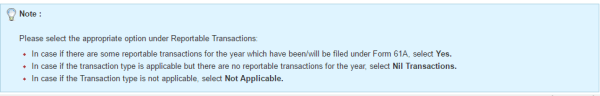

Option NO has been changed to NIL TRANSACTIONS in SFT preliminary report.

Statement of ‘high value financial transactions‘ is required to be furnished under section 285BA of the Income-tax Act, 1961 by ‘specified persons‘ in respect of ‘specified transactions‘ registered or recorded by them during the financial year. The ‘specified persons’ and the ‘specified transactions’ are listed in new Rule 114E of the Income-tax Rules, 1962. In case of individual i.e. Any person who is liable for audit under section 44AB of the Act: He has to report: Receipt of cash payment exceeding Rs. 2,00,000 for sale of goods or providing services of any nature other than those specified So, if the assessee has not received any cash as mentioned above, he should reply to the notice accordingly. Here in this mail it is clearly stated: You are requested to submit the "SFT Preliminary Response" under compliance section post login to eFiling portal.

Read more at: /forum/person-not-made-cash-sale-of-rs-2-lac-has-to-submit-61a--391120.asp

Applies to every person and not only to Individuals.

in simple language

single bill =>2 lac+cash receipt against that bill is 2 lac or more then report in form 61a annually upto 31st may

this has to be seen per transanction in view of on of the notification issued by cbdt on dated in the month of oct 2016

-regards priyam upadhyay(ca final)

Dear sir,

If the assessee has not covered u/s44AB, then he has to file priliminary respone?

Leave a Reply

Your are not logged in . Please login to post replies

Click here to Login / Register

Recent Threads

- Are AI tools like ChatGPT actually useful for CA w

- UK TAX (HMRC) HELP WITH INVESTIGATIONS, DISPUTES,

- Payment processor not transferring or refunding pa

- Form 16 format

- 17(5) Blocked ITC

- Transfer of equity shares to original owner

- Login credentials and payment acknowledgement not

- Export sales not realised payment not received fro

- Capital gain account amount utilisation

- Form 26QB – Section 194-IA: TDS on Full Cons

Related Threads

CAclubindia

CAclubindia