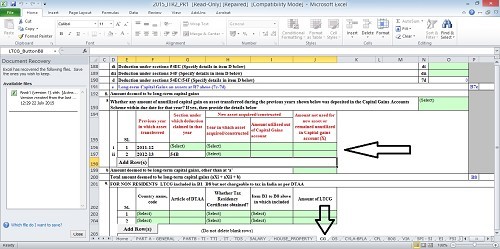

In Schedule "CYLA-BFLA" of ITR 2(Excel Version) of AY 2015-16, I am not able to enter the B/f loss for adjustment against current year capital gains since all the cells are white in colour(meaning they are derived figures and entries cannot be made by the assessee).If one checks the home page of ITR 2,again Schedule "CYLA-BFLA" is shown in white which means entries in this schedule are derived figures.If so,how does one adjust the B/f losses against current year gains?Which Schedule has to be filled up for the same?

Would be grateful for an early response.Many thanks.

CAclubindia

CAclubindia