This is regarding HRA exemption for the financial year 2016 (April 2016 to March 2017).

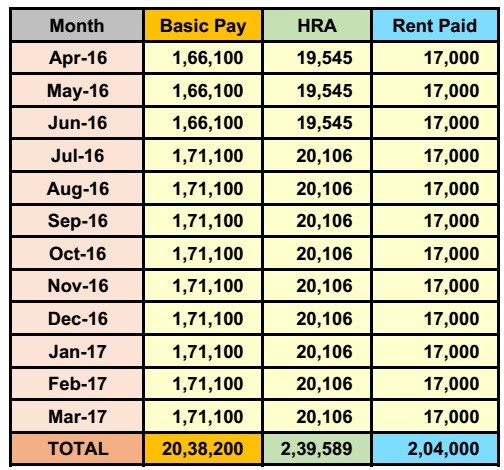

While calculating “Rent Paid in excess of 10% of salary”, I am getting a negative value for the period from July 2016 to March 2017. The monthly details of Basic Pay, HRA received and rent paid are as shown below. Also, the same is attached as spreadsheet file.

What is the methodology for calculating the amount exempted under HRA? Please advice.

Attached File : 1013621 20170309154005 hra.xlsx downloaded: 107 times

CAclubindia

CAclubindia