Menu

Forum Search

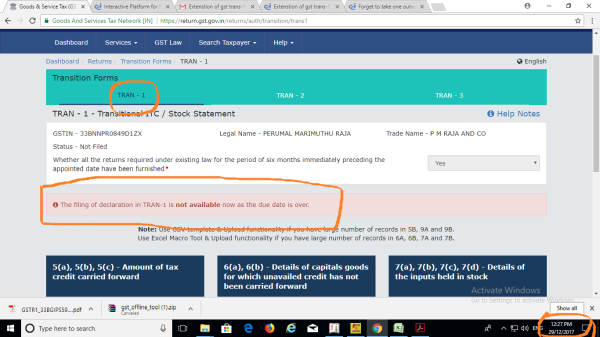

Extenstion of gst trans-1

1. Form GST TRAN-01 ( as last date to file the form was 27th Dec, 2017)

2. Table 6A of Form GSTR-1 (This has been disabled, since Form GSTR-1 is now open for all months. Taxpayers

may now enter the details of exports in table 6A of GSTR-1, while filing Form GSTR-1 of the respective tax

periods. For previous filed table 6A of Form GSTR-1, taxpayer shall be able to view/read through ARN search

only.)

That's Politics...

Also it's not their problem...

That's Our (Public) Problem. Then why they will feel it...?

Very Very Stupid Activities by GSTN...

This is the whatsapp message received throu whatsapp from some of my Chartered accountant friend was unable to verify the because was out of station had some some health issued.What should I do now.to file Tran 1

Govt should extend the time .As this is a liability to the government .The government cant say that I can provide your refund till this date or else I will not provide any refund.This is harassment. Confusion among the public has been made by the government by frequent change to filing dates.The common public can keep track of this date

GSTN portal especially TRAN 1 filing option not available in portal...

| Originally posted by : manjunath | ||

|

pls tell me whether it is extended or not |  |

No availability in portal...

When, under existing act ,we had already shown the carried forward input credit amount in its last june month return then it should be automatically reflected in GST credit ledger....why this due date for filing trans 1? ......let it be open na.....anyone can file their declaration any time ...why this time restriction?

can we file the TRAN1 or not, now ?

| Originally posted by : Surajit | ||

|

can we file the TRAN1 or not, now ? |  |

No...

Not available in Portal....

then Sir, what is the solution ?

| Originally posted by : Mondira Saha | ||

|

no chance now to any extension . its over clear by gov |  |

hi, is there any possibility to get back the ITC avail in our VAT ?

Leave a Reply

Your are not logged in . Please login to post replies

Click here to Login / Register

Recent Threads

- Indexation Benefit available or not on Calculation

- Documents for return exhibition material

- Can I set off equity losses(both short term loss a

- Input tax credit on rent to rent

- Family Pension Army

- Waste Management services

- Seeking Clarity: New Transport Allowance Limits (D

- Query regarding Consolidated Gift Deed for Bank Tr

- TDS u/s194IB - Joint Ownership

- Free GST Reconciliation Tool in Google Sheets R

Related Threads

CAclubindia

CAclubindia