Menu

Employers category in itr 2

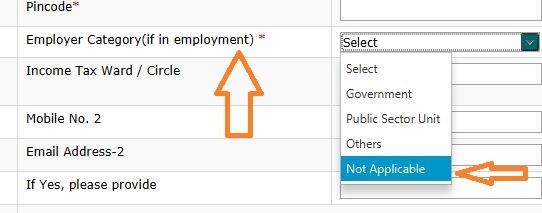

An officer retired voluntarily from BSNL.He is getting pension from Govt. of India,DOT O/O CCA Gujarat Circle,Ahmedabad.through Gandhinagar Post Office. In ITR 2 what will be his Employer Category to tick ? Govt or PSU or Others ?

Replies (10)

Recent Threads

- TDS u/s194IB - Joint Ownership

- Free GST Reconciliation Tool in Google Sheets R

- NRI return after due date refund case

- TDS u/s 194J - training honorarium

- WHERE TO REGISTER UNDER PTRC AND PTEC ACTS ?

- Key Corporate Compliance Requirements for Private

- Gst Non Filling Return Notice

- GSTR 2B ( MULTIPLE MONTHS )

- Eway bill generation for export material.

- International Tax clarification UK.

Related Threads

CAclubindia

CAclubindia