I am making payment against annual return 17-18 Voluntry for ITC reversal.

I have sufficied balance in Cash Ledger Balance.

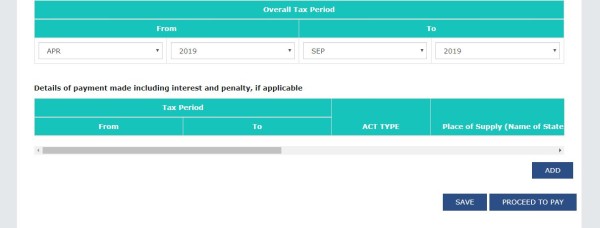

While making payment (Voluntary Payment) each time I am getting

Error : Enter the correct amount(Sum of Cash/ITC) that is equal to the amount to be paid towards liability.

All the amount are correct four time checked.

Please guide me.

DETAILS OF PAYMENT ARE NOT AVAILABLE TO ENTER. PLEASE TELL ME HOW TO RECTIFY THIS

DETAILS OF PAYMENT ARE NOT AVAILABLE TO ENTER. PLEASE TELL ME HOW TO RECTIFY THIS

CAclubindia

CAclubindia