Others

458 Points

Joined July 2014

| Originally posted by : Kapadia Pravin |

|

Provided that the amount referred to in clause [c] or clause [d] is paid in respect of a senior citizen and no amount has been paid to effect or to keep in force an insurance on the health of such person:There is no co-relation between standard deduction and medical deductions. |

|

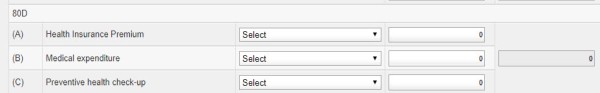

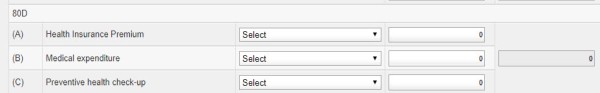

plz tell in layman language...i didnt understand a thing...say i didnt pay a penny and company covers my parent too in the insurance scheme...

1) can i put the medicines bills extra costs in 80D b part

2) for any senior citizen where can they put the bills to claim the deduction with out without health insurance