Menu

44ad and its 5th provision

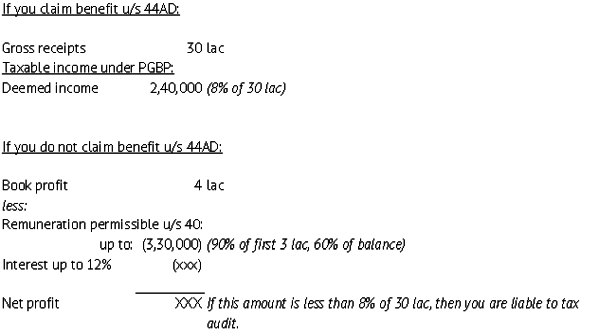

In case of a partnership, net profit for the f.y. 2016-17 is ZERO after allowing interest and remuneration to partners as per section 40 b.

1) Gross receipt 30 lac

2) expenses including purchase.

26 lac

3) interest and remuneration 4 lac

4) net profit 00

Is the firm required to get his books audited u/s 44ab as he is not having any income which is chargable to tax.

Section 44ad(5)

1) Gross receipt 30 lac

2) expenses including purchase.

26 lac

3) interest and remuneration 4 lac

4) net profit 00

Is the firm required to get his books audited u/s 44ab as he is not having any income which is chargable to tax.

Section 44ad(5)

Replies (4)

Recent Threads

Related Threads

CAclubindia

CAclubindia