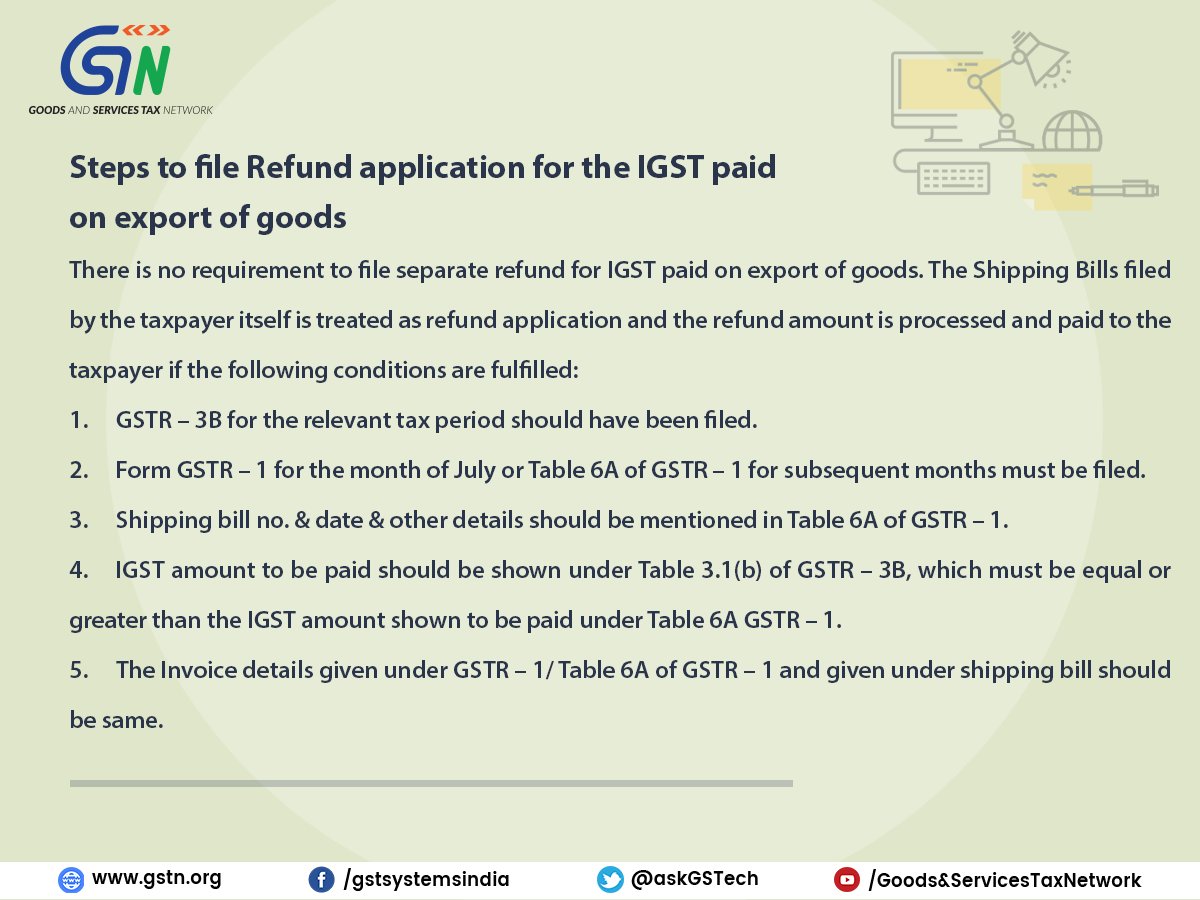

Taxpayers guide to file Refund application for the IGST paid on export of goods.

Resolution for Taxpayers wanting to change their STATE circle name in GST RC.

Resolution for Taxpayers unable to reset and file GSTR-3B due to Error report showing "YOU HAVE ALREADY OFFSETTED GSTR-3B" when CESS liability is yet to be set off.

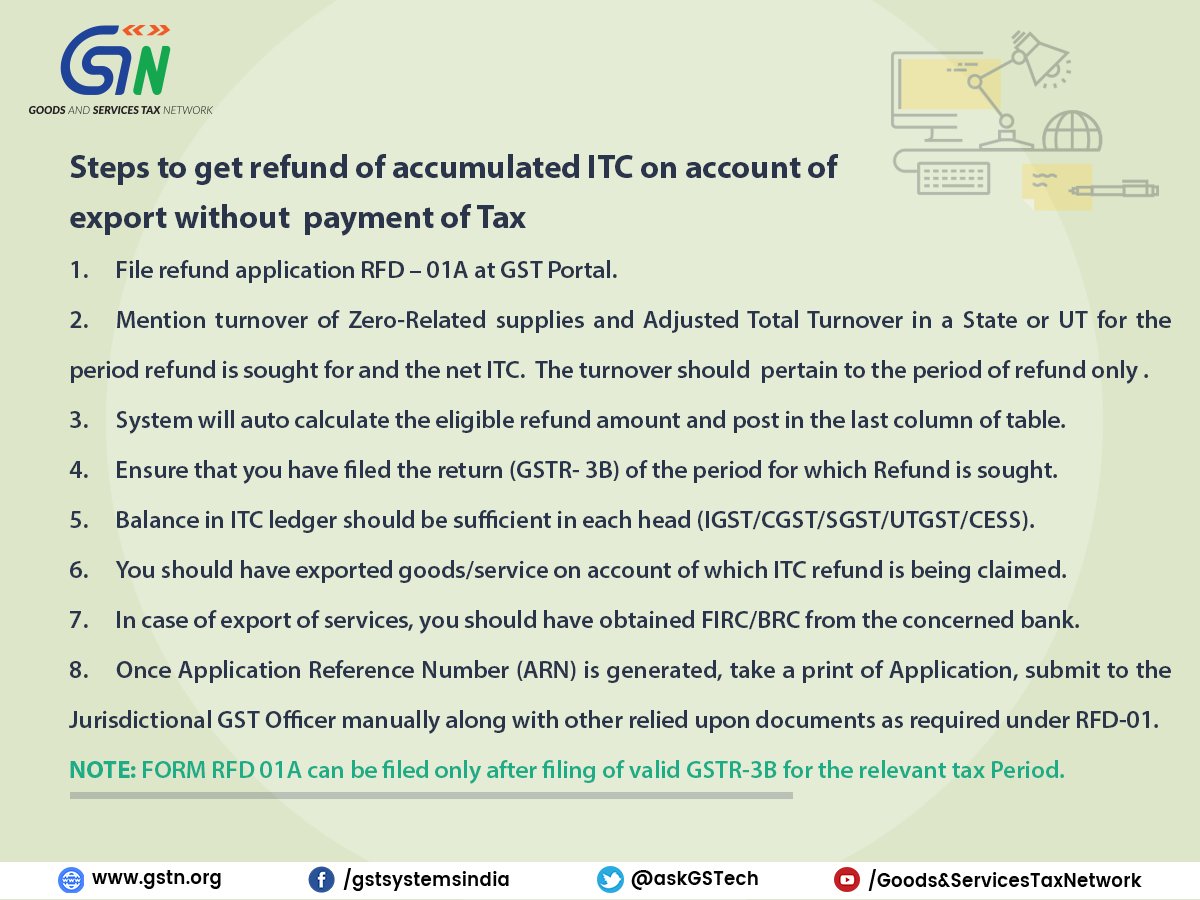

Taxpayers guide to get refund of accumulated ITC on account of export without payment of Tax.

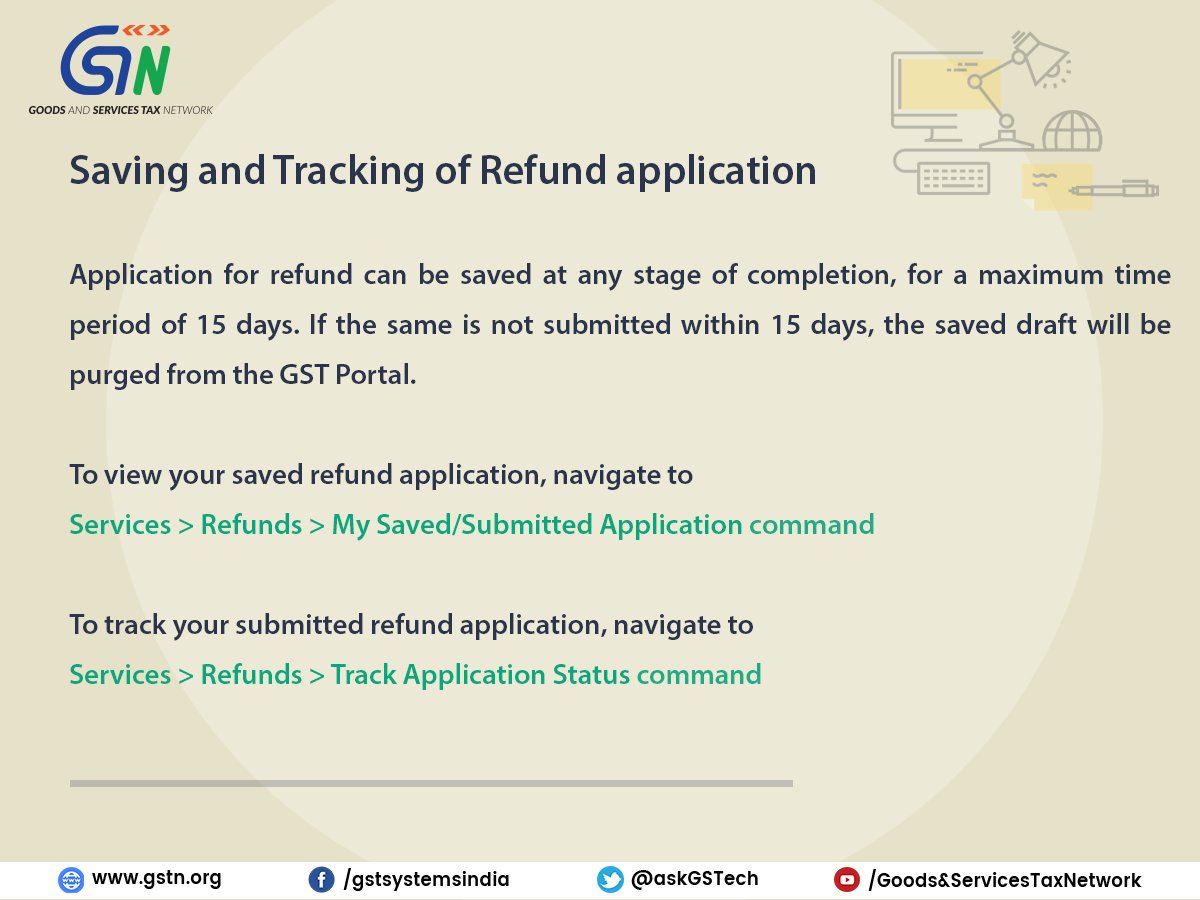

Taxpayers guide for Saving and Tracking of Refund application.

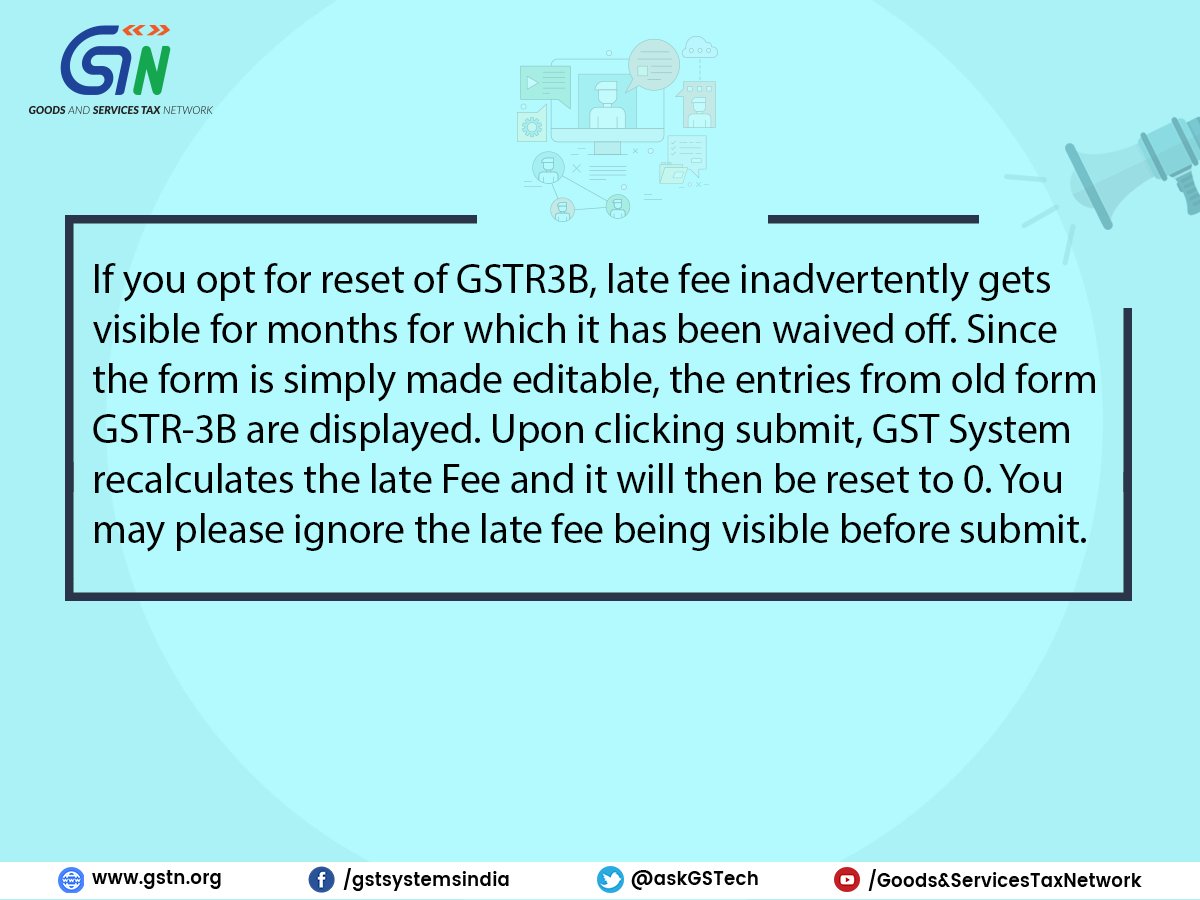

Taxpayers who have opted for reset of GSTR3B, late fee inadvertently gets visible for months for which it has been waived off. Upon clicking submit, GST System recalculates the late Fee and it will then be reset to 0. Please ignore the late fee being visible before submit.

CAclubindia

CAclubindia