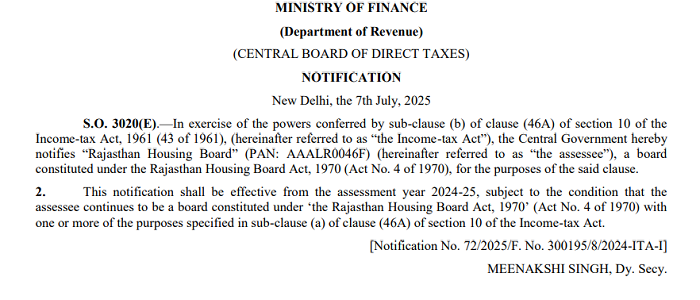

In a significant relief to the Rajasthan Housing Board, the Ministry of Finance has granted income tax exemption under Section 10(46A)(b) of the Income-tax Act, 1961. The Central Board of Direct Taxes (CBDT) issued Notification No. 72/2025 dated July 7, 2025, formally notifying the Board (PAN: AAALR0046F) as an eligible entity for tax exemption with effect from Assessment Year 2024-25.

Established under the Rajasthan Housing Board Act, 1970, the Board works towards the development and regulation of housing projects across the state. With this notification, the Board's income-subject to certain conditions-will be exempt from tax, provided it continues to function under the same statutory mandate and pursues one or more of the purposes outlined in Section 10(46A)(a) of the Income-tax Act.

This move aligns with the government's broader objective to promote affordable housing and empower statutory bodies involved in welfare-oriented activities by easing their financial burdens.

The exemption will remain in effect as long as the Rajasthan Housing Board maintains its statutory character and fulfills the conditions prescribed under the Income-tax Act.

Official copy of the notification has been attached

CAclubindia

CAclubindia