There is a new GST E-Way Bill update regarding the HSN code requirements. Effective October 1, 2023, taxpayers with an aggregate annual turnover (AATO) of Rs. 5 crore or more will be required to use at least a 6-digit HSN code in their e-invoices and e-way bills. Taxpayers with an AATO of less than Rs. 5 crore will still be required to use at least a 4-digit HSN code.

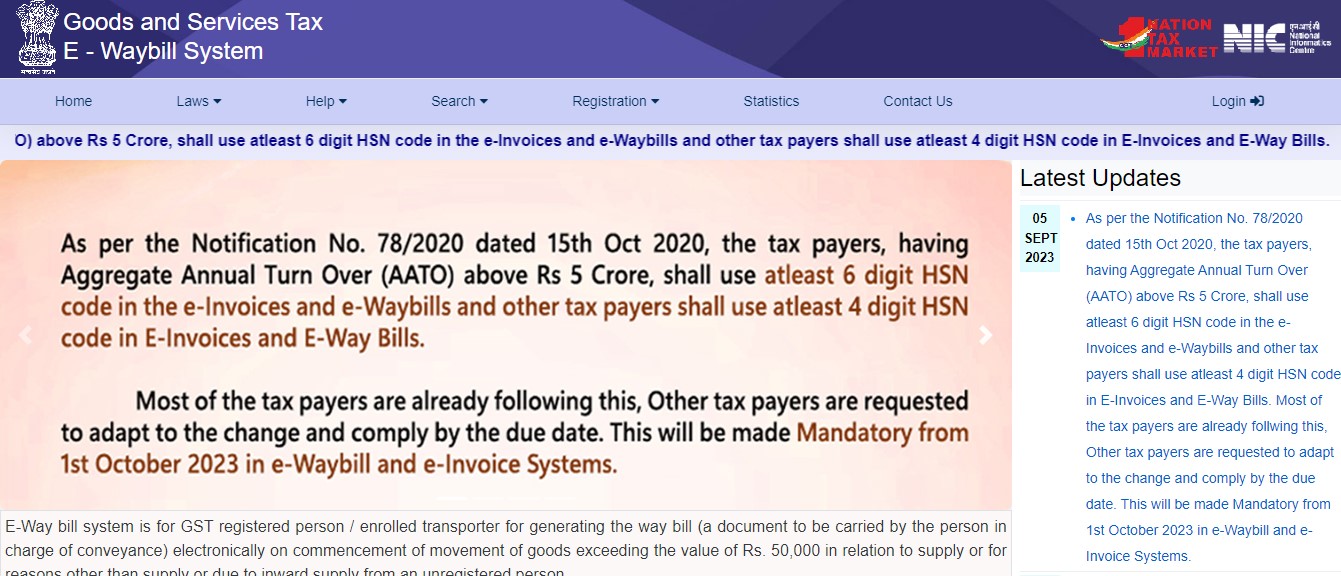

The official announcement is as follows

As per Notification No. 78/2020 dated October 15, 2020, the taxpayers, having Aggregate Annual Turn Over ("AATO") above Rs 5 Crore, shall use atleast 6 digit HSN code in the e-Invoices and e-Waybills and other taxpayers shall use atleast 4 digit HSN code in E-Invoices and E-Way Bills.

Most of the taxpayers are already following this, Other taxpayers are requested to adapt to the change and comply by the due date. This will be made Mandatory from October 01, 2023, in e-Waybill and e-Invoice Systems.

CAclubindia

CAclubindia