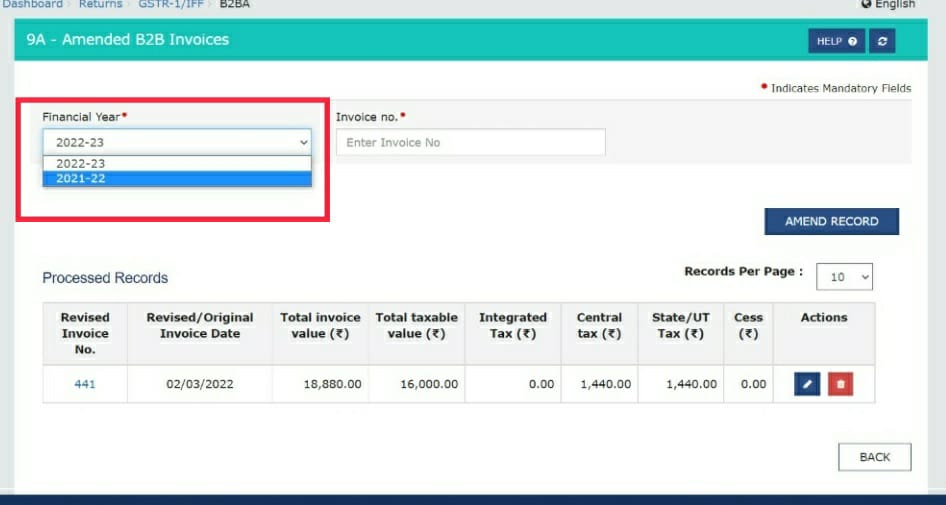

GSTN has started allowing the amendment related to FY 2021-22 in October 2022 return period. This is in line with the recent amendment in the GST Law wherein amendment can be done up to 30th November of the next FY.

The taxpayer can amend the details of taxable outward supplies made to the registered person that is already reported in table 4A, 4B, 6B, 6C – B2B Invoices. The taxpayer shall provide the financial year and invoice number and click on Amend Record to search for the invoice.

As extended by the Government, from time to time, 30th November is the deadline for making GSTR-1 amendments and claiming pending input tax credit (ITC) for FY 2021-22. However, the actual due date is dependent on November’s GSTR-1/GSTR-3B filing deadlines (i.e. pertaining to October’s return period). If a taxpayer misses the relevant deadlines, the GSTR-1/3B cannot be revised. Pending ITC for FY 2021-22, if any, will be forfeited.

The Invoice Furnishing Facility (IFF) is a facility under the QRMP scheme for small taxpayers, who can choose to upload their B2B outward supply invoices each month, for the first two months of the quarter. The invoices relating to the last month of the quarter are to be uploaded in the GSTR-1 return.

CAclubindia

CAclubindia