GST News

GCCI Urges FM for Simplified GST Structure, Industry-Specific Guidance Notes

29 August 2025 at 08:34The GCCI has urged FM Sitharaman to simplify GST by merging slabs, correcting inverted duty structures, reducing rates on essentials, and publishing sector-specific guidance notes to ease compliance and boost tax transparency.

ICAI Releases Updated Handbook on GST Exempted Supplies - April 2025 Edition

28 August 2025 at 09:05ICAI has published the 2025 edition of its Handbook on Exempted Supplies under GST, covering latest amendments till April 15, 2025.

GST Refund Relief for Edible Oils Likely on GST Council Agenda, Says Food Secretary

28 August 2025 at 08:58Food Ministry backs edible oil industry's demand to lift GST refund restrictions. GST Council may discuss the issue in its next meeting.

Multiplex Industry Seeks GST Rationalisation on Movie Tickets to Boost Screen Expansion

28 August 2025 at 08:50High GST is hurting multiplex recovery. Exhibitors propose 5% GST on tickets under Rs 300 to drive affordability and cinema screen expansion.

Karnataka Commercial Taxes Dept Arrests Fake Bill Trader in Multi-Crore GST ITC Scam

27 August 2025 at 08:54The Karnataka Commercial Taxes Department has arrested Bidar resident Rahul Kishan Rao Kulkarni in Hyderabad for creating fake GST registrations and issuing bogus invoices worth crores to facilitate fraudulent ITC claims.

CBIC Urges Public to Avoid Speculation on GST Rates Ahead of Council Meeting

27 August 2025 at 08:40CBIC cautions against premature speculation on GST rate changes. Official decisions to be announced after the GST Council meeting on September 3-4, 2025.

Chartered Accountant and his Associate Booked for Rs 217 Crore GST Scam Using Forged Signatures

26 August 2025 at 09:44Navrangpura police have booked a chartered accountant and his associate in Ahmedabad for allegedly defrauding a businessman of Rs 217 crore through forged signatures and bogus GST transactions.

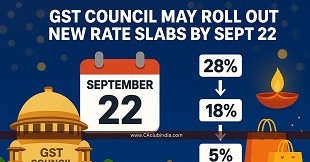

Centre Braces for Rs 40,000 Crore Revenue Loss as GST Overhaul Nears

26 August 2025 at 09:35Centre braces for Rs 40,000 crore revenue loss as GST reforms shift to two slabs of 5% and 18%.

GST Council May Roll Out New Rate Slabs by September 22, Ahead of Festive Season

26 August 2025 at 09:12GST Council may roll out new two-slab GST rates around September 22 to boost festive demand, with cuts likely after its September 3-4 meeting.

GST Rationalisation: Real Estate Sector Poised for Major Boost

25 August 2025 at 08:54The GoM on GST rationalisation has approved a two-slab structure of 5% and 18%, removing 12% and 28% rates. Experts say the move could cut housing costs, boost buyer sentiment, and improve transparency in India's real estate sector.

Popular News

- Exceptions for Cash Payments Above Rs 10,000 under Rule 26 of Draft IT Rules 2026

- CBDT to Replace Forms 3CA, 3CB & 3CD with Consolidated Form 26

- Income Tax Rules, 2026 Notified: Rule-Wise Comparison with Old IT Rules, 1962

- Draft Income Tax Rules, 2026 Released: Major Changes in Capital Gains, Perquisites and Non-Resident Taxation

- CBDT Proposes New Form 130 for TDS on Salary, Pension and Interest Income Under IT Act

Trending Online Classes

-

DT & Audit (Exam Oriented Fastrack Batch) - For May 26 Exams and onwards Full English

CA Bhanwar Borana & CA Shubham Keswani

CA Bhanwar Borana & CA Shubham Keswani -

IDT LIVE Exam Oriented Batch | May 2026, Sept 2026 & Jan 2027

CA Arpita Tulsyan

CA Arpita Tulsyan

CAclubindia

CAclubindia