Menu

Forum Search

What if supplier has not filed Gstr1 ?

Aman Agarwal

ASHISH PALLOD

Now, my next question is, If i don't want to rely on my supplier's gstr1 filing for my itc on purchases, can i take gst invoices by supplier on rcm basis ? So that i will pay the gst on my purchases and claim itc on those purchases in the same month's return, ना रहेगा बांस ना बजेंगी बासूरी ।

how can you take invoices on RCM basis when your supplier is registered dealer.

| Originally posted by : Aman Agarwal | ||

|

No. A seller cannot accept invoices in GSTR 1A if he has not filed GSTR 1 |  |

Quoting from cleartax:

Certain transactions may not be auto-populated because-

- Seller did not file GSTR-1

- Seller filed GSTR-1 but he missed the transaction

In either case, the buyer can manually add these transactions. The seller will get a notification to accept this addition/modification in his GSTR-1A return.

According to above statement, a supplier can accept invoices in GSTR1A even if hasn't filed GSTR-1.

ASHISH PALLOD

ASHISH PALLOD

Is it permissible to post the another website link. If so i can post the link.

| Originally posted by : anshul aggarwal | ||

|

Andybut question still remains unanswered whether supplier is allowed to accept gstr1A changes if he has not filed GSTR1? |  |

Quoting from cleartax:

Certain transactions may not be auto-populated because

- Seller did not file GSTR-1

- Seller filed GSTR-1 but he missed the transaction

In either case, the buyer can manually add these transactions. The seller will get a notification to accept this addition/modification in his GSTR-1A return.

Dear Anshul, as stated by this external site, it seems a supplier can accept invoices in GSTR1A even if hasn't filed GSTR-1.

Aman Agarwal

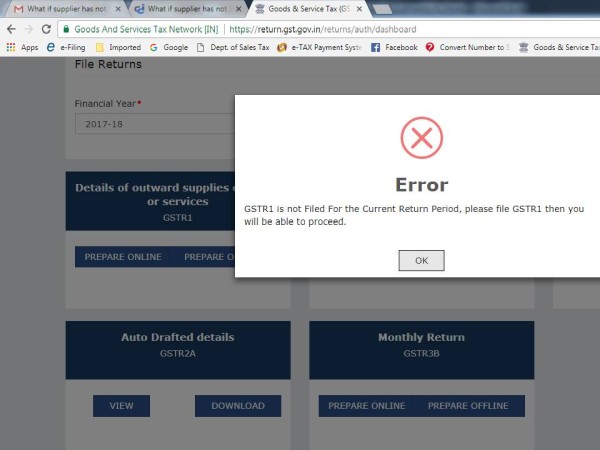

Here is a screenshot of the error message displayed while accessing GSTR 1A without filing GSTR 1

@ CT website,

that means sites are misleading people with wrong information.

There should have been dedicated govt GST web forum where certified tax experts must be answering queries.

But i think even officials are not clear what's going on at the backend until it appears on the site.

GST - Joke of the year.

Aman Agarwal

Agreed. They should have set up proper helpdesk services to respond to thousands of queries of the taxpayers.

ASHISH PALLOD

My supplier has uploaded the invoice correctly and are visible to me but i cant accept them as he has not filed GSTR1. Now after 31st oct (last date for filing gstr2) when he files gstr1, would i get chance to accept them and same would be added in my ITC for july or i have to pay tax this month.

Shankar Sharma

Leave a Reply

Your are not logged in . Please login to post replies

Click here to Login / Register

Recent Threads

- Waste Management services

- Seeking Clarity: New Transport Allowance Limits (D

- Query regarding Consolidated Gift Deed for Bank Tr

- TDS u/s194IB - Joint Ownership

- Free GST Reconciliation Tool in Google Sheets R

- NRI return after due date refund case

- TDS u/s 194J - training honorarium

- WHERE TO REGISTER UNDER PTRC AND PTEC ACTS ?

- Key Corporate Compliance Requirements for Private

- Gst Non Filling Return Notice

Related Threads

CAclubindia

CAclubindia