Respected All,

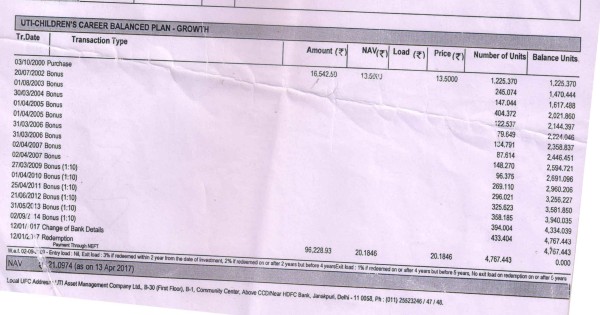

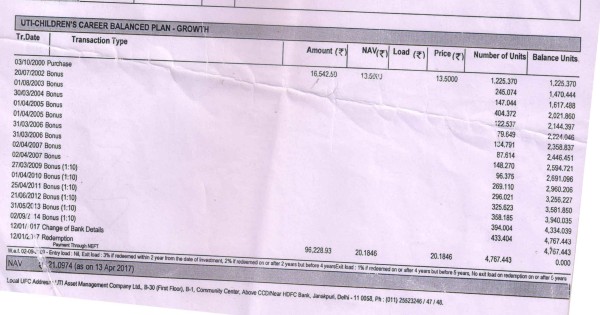

Please find attached herewith Statement of Mutual Fund, Please let me know its capital gain with computation Or calculation of it.

Thanking You,

Respected All,

Please find attached herewith Statement of Mutual Fund, Please let me know its capital gain with computation Or calculation of it.

Thanking You,