PLEASE PROVIDE WORKING NOTES ON:

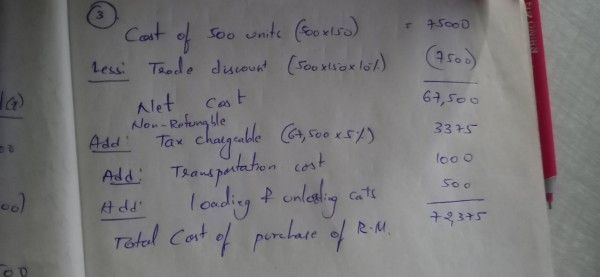

Y LTD PURCHASED 500 UNITS OF RAW MATERIALS @ RS. 150 PER UNIT GROSS LESS 10% TRADE DISCOUNT SALES TAX IS CHARGEABLE @ 5% ON THE NET PRICE.

THE EXCISE DUTY ELEMENT ON PRODUCT IS RS.12 PER UNIT AGAINST WHICH MODVAT CAN BE CLAIMED.

THE COMPANY SPENT RS.1000 ON TRANSPORTATION AND RS 500 FOR LOADING AND UNLOADING.

CALCULATE THE COST OF PURCHASE OF RAW MATERIAL.

ANSWER IS RS.72,375.

CAN ANYBODY SAY HOW THIS ANSWER IS ARRIVED..

ls this right ?

ls this right ?

CAclubindia

CAclubindia