Hello Experts,

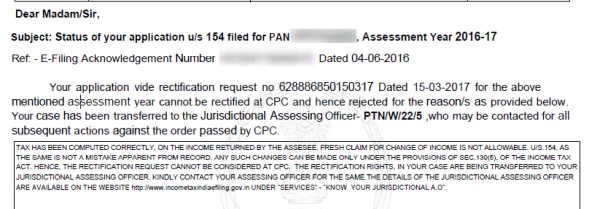

I'm facing one another problem related to my income tax rectification. I observed in my form 16 for the assessment year 2016-17 that the HRA has not been considered by my company and excess tax has been filed mistakenly. I have requested the rectification for the same on 10-03-2017 and file has been forwarded to my local jurisdiction Bihar Sharif, Bihar. I contacted them and Since I'm working in Coimbatore I asked my brother to get the details and status but the problem is the ITO officer is not responding properly and they are always asking him to come on another day. After that I filed RTI on 06.04.017 to Chief Commissioner of Income Tax (CCA) , Patna to know the status of my tax rectification.

Now I need suggestion that as per RTI Act 2005 will I get any help from RTI on this and how many days RTI could take to provide me the information. Also how I can proceed further here in this case. Will I be able to get the excess tax paid or not?

Please let me know for any further details.

Once again Thanks for your time and have a good day!

Regards,

Rohit Kumar.

Menu

Tax rectification & refund

Replies (14)

Recent Threads

- Understanding section 269st

- CASH AS GIFT OR FD AS GIFT

- NPS Pre Maturity full exit taxation rules

- Planning to ceased a Business

- Taxation for sale and purchase of REIT shares

- PAN - AADHAR LINK

- RECONCILIATION OF GSTR 2B Vs BOOKS WITH VBA

- Regarding cancellation of GST Number

- GST on business receipts pre -registration

- A Restaurant registered under the Composition Sche

Related Threads

CAclubindia

CAclubindia