Dear all,

My input IGST =80000

Output IGST =12000

OUTPUT CGST = 45000

OUTPUT SGST =45000

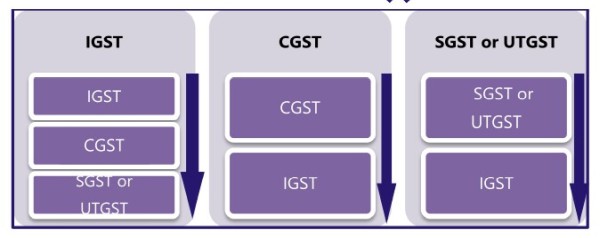

What is my tax liability? How is set off?

Menu

set off tax liability

Replies (4)

Recent Threads

- TDS Challan interst amount wrongly paid as surchar

- Query on TDS & Stamp Duty

- Query on form 26QB and TDS deduction

- Received this confusing IT notice. How to reply

- Houston Sign Company For Custom Signs, Banners &am

- Refund due to change in GST Rate Tobacco Products

- Lease related query can we rent out lease ?

- Planning of Ceased a Business i.e Closure of Compa

- Property value in 26QB

- Form 26QB Multiple Buyer/Multiple seller

Related Threads

CAclubindia

CAclubindia