Busy 3.6 E

Busy Enterprise Edition Launched. Free download from

|

Major Changes

|

|

|

|

|

|

|

|

|

|

|

|

|

Busy 3.6 E

Busy Enterprise Edition Launched. Free download from

|

Major Changes

|

|

|

|

|

|

|

|

|

|

|

|

|

How to post voucher for getting vat input on capital goods for the state of punjab

hi i am using demo copy of Busywin 36 e-15 can you tell me how to post the voucher for for getting vat input on capital goods in VAT-15,VAT-24.

for more clarification VAT-15 contains the whole detail of purchases and sales with in a quarter.

and VAT-24 contains the supplier wise detail of purchases with in state.

one more query is that Busywin not showing the Part B of VAT-20 (annual return of Punjab Value Added Act) please tell me how can i enable Part B for VAT-20.

for more clarification you can download the softcopy of VAT-15,VAT-24 and VAT-20 from

https://www.pextax.com/revised_VAT_Forms.htm

With regards

Devinder

Hi Devendra,

You have to add separate purchase voucher type for capital purchase. Goto Admin>Master>Purchase Type>Add >Captial Purchase

Set this option to 'Y' if the Purchase Type is for capital purchases. This option is helpful as Input Tax Credit (ITC) can be claimed on Capital Purchases such as machinery and so on. By specifying 'Y' in this data field, related transactions will be displayed in the ITC column in appropriate reports thus making it easier to claim ITC.

I downloaded & see that Part B of VAT-20 (annual return of Punjab Value Added Act) is for F.Y. 2005-2006 and it is a certificate by CA so might be Busy Team haven't included.

You may email feedback @ busy.in to request to include part B of vat-20.

Regards,

Shailesh

| Originally posted by : Davinder | ||

|

How to post voucher for getting vat input on capital goods for the state of punjab hi i am using demo copy of Busywin 36 e-15 can you tell me how to post the voucher for for getting vat input on capital goods in VAT-15,VAT-24. for more clarification VAT-15 contains the whole detail of purchases and sales with in a quarter. and VAT-24 contains the supplier wise detail of purchases with in state. one more query is that Busywin not showing the Part B of VAT-20 (annual return of Punjab Value Added Act) please tell me how can i enable Part B for VAT-20. for more clarification you can download the softcopy of VAT-15,VAT-24 and VAT-20 from https://www.pextax.com/revised_VAT_Forms.htm With regards Devinder |

|

Great info on here guys, have one quick question though. Personally which printer would you say is better for the quality and speed of barcode label printing? I am looking in to starting up myself and need advising.

Many Thanks

| Originally posted by : dunk | ||

|

Great info on here guys, have one quick question though. Personally which printer would you say is better for the quality and speed of barcode label printing? I am looking in to starting up myself and need advising. Many Thanks |

|

I suggest you to contact feedback @ busy.in as they might have users feedback about your queries.

Busy 3.6 F-3 Busy Enterprise Edition Launched. To download visit here

Major Changes

1. Changes in Client Server licensing policy; now for one count, up to three instances of Busy would be allowed on a single computer. Different scenarios in client server environment are described below:

* Multiple count dongle on server and clients connecting to server independently; till now multiple instances of Busy on a single client computer were consuming multiple counts (each instance would consume individual count). Now for each client computer, up to three instances of Busy would consume a single count and afterwards each instance would consume one extra count.

* Single count dongle on individual client computer; till now unlimited instances of Busy could be run on each client computer. Now up to three instances of Busy would be allowed to run with single count dongle and from 4 th instance onward the program will start in demo mode.

Statutory Changes

1. Orissa Form 201 reframed as per new specifications.

2. Changes in UP Form 24-A (Return for Composition Dealers) for VAT surcharge.

3. Rajasthan Form VAT 11 for Composition Dealers.

4. Kerala VAT e-Return.

5. Maharashtra VAT Annexure-A.

6. Maharashtra VAT e-Return.

7. Balance Sheet in vertical format on screen also with option to show / print Account Level Details also.

8. Consolidated Summary for Item / Account Group provided.

9. In Sales / Purchase Analysis, a new report showing Monthly / Quarterly details for Item / Account / Item Group / Account Group added with provision to compare the results with previous year’s figures.

Minor Changes

1. While enabling Settlement Details in Dual vouchers, the user could choose from Cash/Bank/Party accounts as settlement accounts. Now it has been made open and user can choose any account as settlement account.

Bugs Removed

1. Invoice printing on DMP, sometimes some junk characters were being printed on invoice. Now problem rectified.

2. Access 2 SQL was not working with Nepali Date. Now problem rectified.

3. During voucher feeding, after saving a voucher the default voucher date was getting reset to Beginning FY. Now problem rectified.

4. Voucher Approval enabled with option to Post Unapproved Vouchers set to ‘Y’; after Rewriting Books the account balances of a few accounts were getting disturbed. Now problem rectified.

Coming soon new version Busy 3.9 Busy Enterprise Edition will be launched and it is likely that this version shall be better than Tally for SME.

Shailesh

if any one have shortcut keys of busywin3.6 software please mail me on urgent base becasue on 10th 3pm my exam plsssss mail me all short cut keys of busy software and its

| Originally posted by : narender | ||

|

if any one have shortcut keys of busywin3.6 software please mail me on urgent base becasue on 10th 3pm my exam plsssss mail me all short cut keys of busy software and its narender.account @ rocketmail.com |

|

from help menu you can find all shortcut keys.

a) To provide state-wise different tax rates for a single item.

b) To provide Branch-wise different prices for a single item.

c) To provide checks & controls for different users working online from different branches in a single company.

d) To filter various reports branch-wise.

a) In case of Tax Rate change, we only need to specify the changes in Tax Category master. Till now tax rates need to be changed in all items individually.

b) Problems arising out of Tax Rate changes during the year will be handled easily.

c) Separate tax rates can be specified Branch wise for same item.

a) Enable from Feature/OptionsàEnterprise Features.

b) Create different Master Series Groups from Master Maintenance.

c) While creating masters (Accounts, Groups, Items etc.), tag each master with a single or multiple Master Series Groups.

d) Assign Master Series Group with user. This will filter the masters available to a user during data entry and reports.

a) Option to specify Broker at item level. Till now broker at voucher level was available.

b) Default broker and brokerage can be specified either at Item level or Party level.

c) Option to freeze Broker / Brokerage with Party or Item.

d) Option to automatically post brokerage voucher-wise.

See more details in attached files.

Request all Busywin users to sent email to feedback @ busy.in to integrate BUSYPAY (Payroll Software) in Busy Accounting Software.

Click here to download new Busy 3.9. It has a good Branch Management features.

Hi guys..

i was trying to install the latest version Busy 3.9a7. please help on how to install the server information details.

You need to set server information only if you have sql & set database type as MS Sql insted of MS Access from the Select Busy Model Dialog. For Demo purpose you may set MS acces as Daatabase Type and see the lovely feature of BUSY.

BTW here is info from its help file and for more details see attached file.

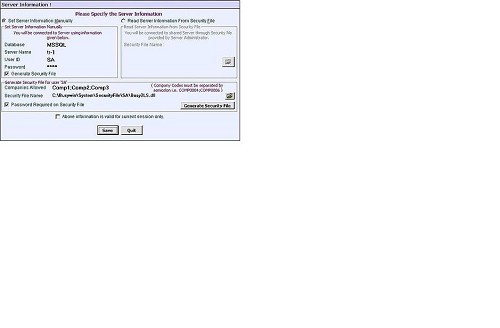

This option appears in Company menu, if you are running BUSY in Client-Server mode. While running BUSY in Client-Server mode, instead of Set Data Directory, Set Server Information option appears. With the Set Server Information option, you can set server information either manually or can generate a security file from where the server information can be read. On clicking the Set Server Information option under Company menu, a Server Information window appears. Given here is a screenshot of Server Information window.

Set Server Information window

In the Server Information window, there are two options. The options are:

Select this option, if you want to specify server information manually. On selecting this option, a Set Server Information Manually group gets activated. In the group there are various data fields and one option. The data fields and option are:

Specify the database name in this data field. (Fixed as MSSQL for the time being).

Specify the Server name in this data field as specified at the time of registering a new Server.

Specify a valid MSSQL server User ID in this data field. Default MSSQL user name is Sa.

Specify password that you have specified for the user name at the time of registering for a new server.

Select this option if you want to generate a security file. Security file is generated to hide server details from the clients. The benefit of generating security file is that you do not have to give server details to the clients. Instead you just have to give the path of the security file to the clients and they can then be able to work on the server. On selecting this option, a group gets activated. The group is:

In this group two data fields, one button and one option appears. The data field, button and option are:

Specify the code of the companies to which the user will have access. Companies code must be separated by semicolons (;). For example, you want that user can access only three companies Comp001, Comp002 and Comp003. In such a case, you have to specify Comp001;Comp002;Comp003 in this data field.

Specify the path and the name for the security file. You can also select the path by using the Browse button.

Click this button to generate the security file.

Select this option if you want to make the file password protected. Benefit of giving password is that only those clients to whom you have disclosed the password will be able to connect to the server. If you select this option then a Security File Password window appears. Given here is a screenshot of Security File Password window.

Security File Password window

Select this option if you want to read server details from the security file. This option is more useful for the clients. To use this option it is necessary that you have already created a Security file. In this option, you have to specify the name of the security file from which the information is to be read. After providing a valid security file name, you will be able to connect to the server. On selecting this option, a Read Server Information from Security File group gets activated. In the group there is one data field. The data field is:

Specify the path for the required security file or you can select the path by clicking the Browse button. If you select a file on which password has been provided then you have to give the password for the file and only then you can connect to the server.

Select this checkbox if you want that the Server information provided in the Server Information window will be saved only till the BUSY is opened. Once you close the BUSY and again open it then the default Server information will appear. On the other hand, if you do not select this checkbox then the information specified in the Server Information window will get saved and next time when you open BUSY then the saved information will be displayed in the Server Information window.

After entering the necessary details, click the Save button to save the Server information.

Your are not logged in . Please login to post replies

Click here to Login / Register

CAclubindia

CAclubindia

India's largest network for

finance professionals