Registered Valuer under Companies Act, 2013

Section wise Requirement of Registered Valuers

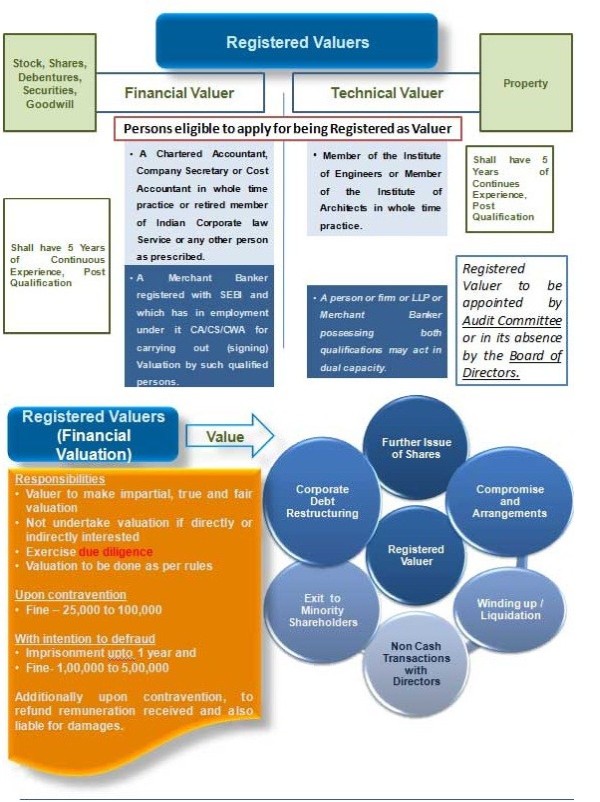

- Section 62 (1) (c) – For Valuing further Issue of Shares

- Section 192 (2) – For Valuing Assets involved in Arrangement of Non Cash transactions involving Directors

- Section 230 (2) (c) (v) – For Valuing Shares, Property and Assets of the company under a Scheme of Corporate Debt Restructuring

- Section 230 (3) and 232 (2) (d) – For Valuation including Share swap ratio under a Scheme of Compromise/Arrangement, a copy of Valuation Report by Expert, if any shall be accompanied

- Section 232 (3) (h) - Where under a Scheme of Compromise/Arrangement the transferor company is a listed company and the transferee company is an unlisted company, for exit opportunity to the shareholders of transferor company, valuation may be required to be made by the Tribunal

- Section 236 (2) – For Valuing Equity Shares held by Minority Shareholders

- Section 260 (2) (c) – For preparing Valuation report in respect of Shares and Assets to arrive at the Reserve Price or Lease rent or Share Exchange Ratio for Company Administrator

- Section 281 (1) (a) – For Valuing Assets for submission of report by Company Liquidator

- Section 305 (2) (d) – For report on the Assets of the company for preparation of declaration of solvency under voluntary winding up

- Section 319 (3) (b) – For Valuing the interest of any dissenting member of the transferor company who did not vote in favour of the special resolution, as may be required by the Company Liquidator

- Section 325 (1) (b) – For valuation of annuities and future and contingent liabilities in winding up of insolvent company

Registered Valuers (Draft Rules) – Methods of Valuation

I.Before adopting methods, decide Valuation Approach-

|

• Asset Approach |

|

|

• Income Approach |

|

|

• Market Approach |

II.Valuer to consider following points while undertaking Valuation-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

III.Registered Valuer shall make valuation of any asset in accordance with any one or more of the following methods-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IV.Registered Valuer shall make valuation of any asset as on the Valuation date and in accordance with applicable standards, if any stipulated for this purpose.

V.Contents of Valuation report shall contain information as contained in Form 17.3

Registered Valuers (Forms) – Contents of Valuation report

|

(1) Descripttion of valuation engagement |

|

|

(a). Name of the client: |

|

|

(b). Other intended users: |

|

|

(c). Purpose for valuation: |

|

|

(2) Descripttion of business/ asset / liability being valued |

|

|

(a). Nature of business or asset / liability |

|

|

(b). Legal background |

|

|

(c). Financial aspects |

|

|

(d). Tax matters |

|

|

(3) Descripttion of the information underlying the valuation |

|

|

(a). Analysis of past results |

|

|

(b). Budgets, with underlying assumptions |

|

|

(c). Availability and quality of underlying data |

|

|

(d) Review of budgets for plausibility |

|

|

(e) Statement of responsibility for information received |

|

|

(4) Descripttion of specific valuation of assets used in the business: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(5) Confirmation that the valuation has been undertaken in accordance with these Rules

|

(6) Further it is certified that valuation has been undertaken after taking into account relevant conditions/ regulations/rules/notifications, if any, issued by the Central/State Government(s) from time to time. |

|

|

(i). |

The valuation report must clearly state the significant assumptions upon which the value is based. When reporting there may be instances, where there are confidential figures, these must be summarized in a separate exhibit |

|

(ii). |

In his valuation report, the registered valuer must set out a clear value or range of values along with the reasoning |

|

(iii). |

In case the valuer has been involved in valuing any part of the subject matter of valuation in the past, the past valuation report(s) should be attached and referred to herein. In case a different basis has been adopted for valuation (than adopted in the past), the valuer should justify the reason for such differences |

Source: https://corporatevaluations.in

CAclubindia

CAclubindia