CA Practice

85 Points

Joined September 2014

Thanks Manishji, but do I enter negative value there ?

Actually let me elaborate :-

As at 1.4.18, block TRUCK = 20 lacs

On 1.4.2018, TRUCK # 1 sold for Rs 5 lacs, while depreciated book value of Truck # 1 was 4 lacs

So there is book profit of Rs 1 lacs. This is added in other income to arrive at book profit for 18-19, lets say Rs 10 lacs

Now when computing tax payable, this profit on sale of Truck # 1 (i.e Rs 1 lacs) needs to be deducted from book profit of Rs10 lacs.

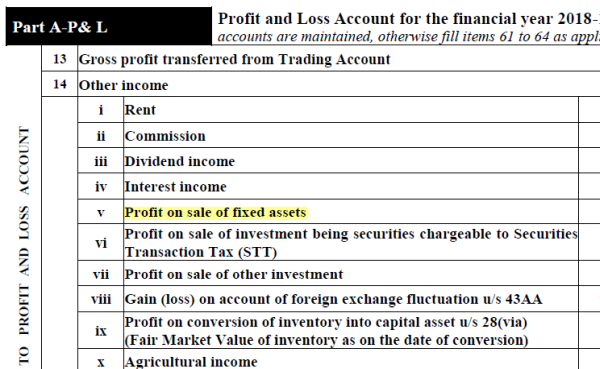

In the section Profit & Loss Row - 14 point (v) mentioned by you, it seems profit is being added to computation and not deducted as I think it must be.....

Please correct me if I'm wrong, but as per Section 50, if block wdv at end of FY is not zero then capital gain on depreciable asset is NIL....

Shruthi

CAclubindia

CAclubindia