16 Points

Joined September 2017

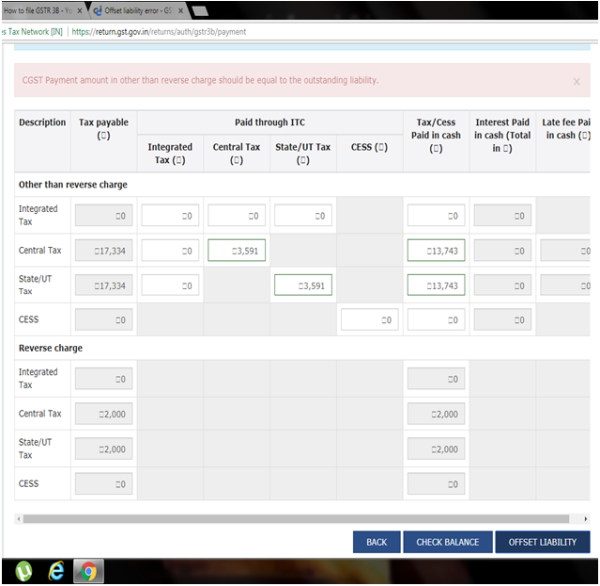

I have the problem in setoff liability . During offset , i got the error "cgst payment amount in other than reverse charge should be equal to the outstanding liability".

In otherthan reverse charge:

MY CGST Liability-17334 ITC BALANCE IN CGST :3591 CASH BALANCE IN CGST :15743

MY SGST Liability-17334 ITC BALANCE IN SGST: 3591 CASH BALANCE IN SGST: 15743

So I ADJUST Like this (image shown above).

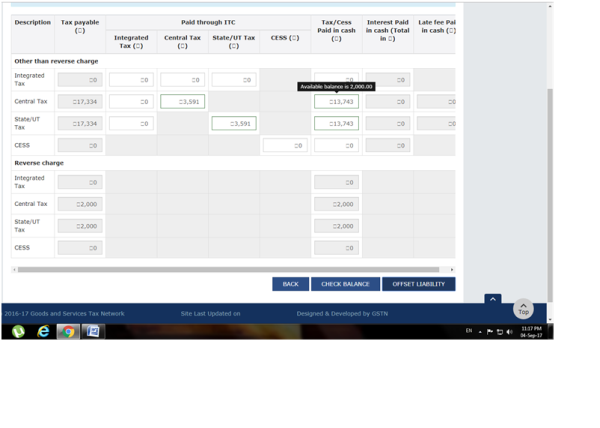

and now i have the remaining cash balance in CGST -2000 & SGST-2000.

But still i got the error mentioned above.

I Cannot offset liability.How to offset?please help to file my return