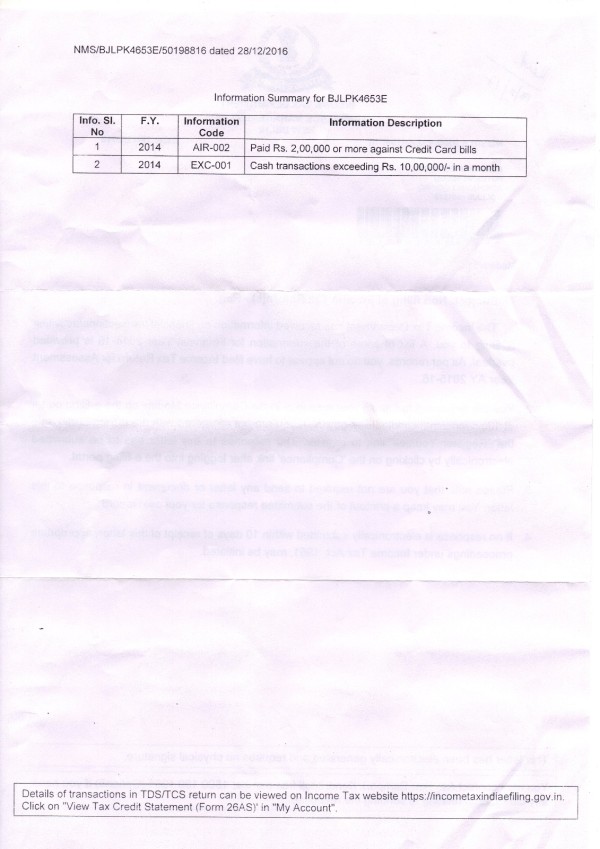

I got the following letter from IT Department which is attached along. They ask for my response via e-filing. I am a self employed person with an annul income less than 2 lakhs a year. As per the notice from IT department i did spend 2 lakhs on credit card bills and 10 lakhs of cash transactions in my a account in a month.

1. I did help my friend in booking flight and hotel to USA using my credit card and which accounts to 2 lakh.

2. For my wedding expenses i took a loan from my parents and relatives and hence high cash transcaiton of 10 lakhs in a month may be as they say.

what should i do now. i am confused and worried. i am a man who try hard to meet my monthly bills.

CAclubindia

CAclubindia