Hi,

What is the time period under which one can invest in Government bonds (54EC) to Save tax on income from selling of a piece of land?

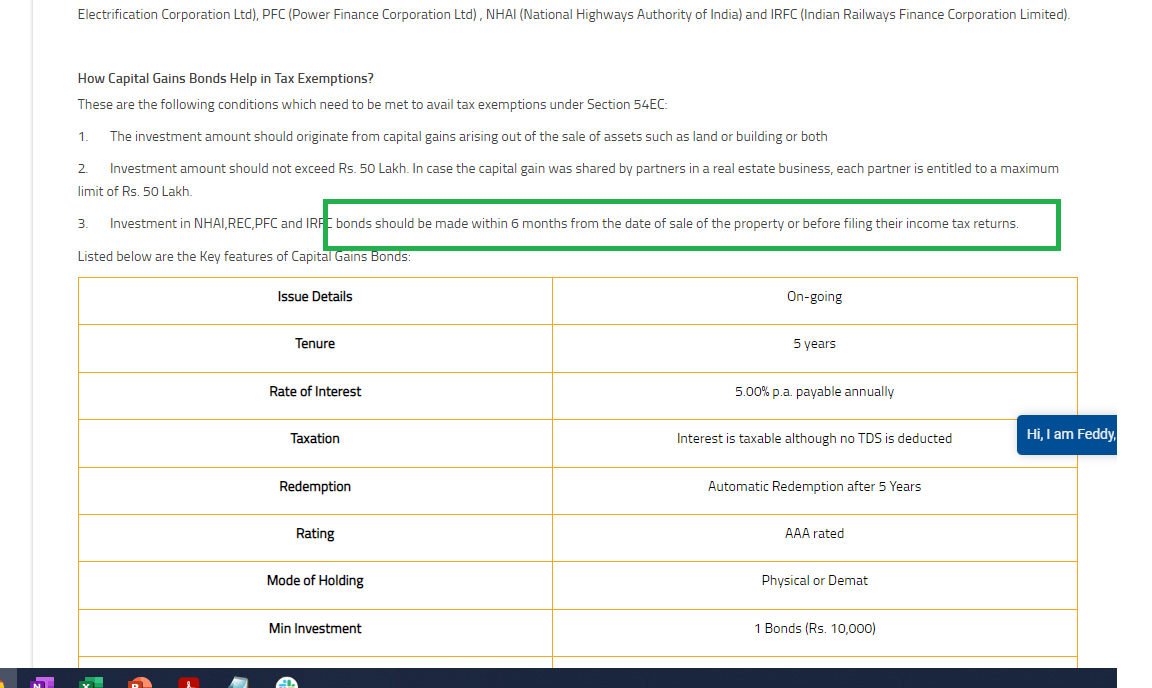

Income tax website says it should be withing 6 months of the transfer but some of the bank website says

"Investment in NHAI,REC,PFC and IRFC bonds should be made within 6 months from the date of sale of the property or before filing their income tax returns."

In our case transfer happened in Month of NOV 2021

Any guidance will really help in deciding.

Thanks, in Advance

in Advance

CAclubindia

CAclubindia