Hello guys,

I filed Online ITR for my friend, but I made a mistake in picking the wrong ITR Form.

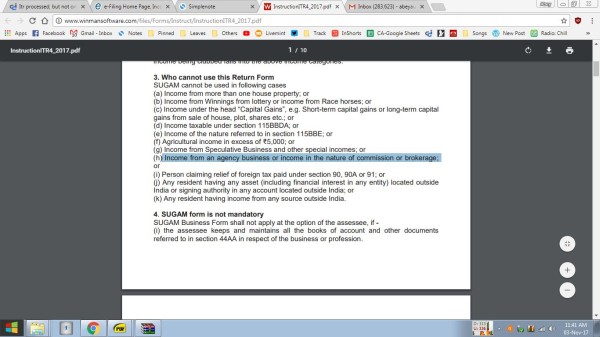

My friend is getting his income as comission by working as an insurance agent. His income is below taxable threshold but have refund because of TDS.

I filed the reutrn for him in ITR-4, but then I was told that ITR-1 shall be used for commissions,so I filed a revised return using ITR-1.The refund claimed in both ITR is the same.

Last week I got intimation via email and it says the refundable amount as I claimed, but the intimation was for the Original return (ITR-4). When I logged into the ITD website, it says Orignal as "ITR Processed" and revised as "ITR-V Received".

He have not received the said amount in his bank account yet. My question is, what happens next? Will the revised return be cancelled? Or will they hold up the refund and release it only after processing the revised return?

Can anyone who had such situation share their experience?

Best Regards,

Abey

CAclubindia

CAclubindia