Menu

Forum Search

Income tax return has been selected under risk management process

Phaneendra Babu

Hi,Mr.Shiva...don't you not aware of your professional code of conduct and Management/Tax/Accounting/IT Implementation activities deems to be considered as consulting even not holding COP as decided by the Council of ICAI.

Phaneendra Babu

I really Appreciate the efforts you put in responding to queries of tax payers, Madam Sheena ji...and I too leaving it here and not intrested to drag the things, but giving a suggestion to my frnd Mr.shiva....thats it.

|

Thank you sir Originally posted by : Phaneendra Babu |

||

|

I really Appreciate the efforts you put in responding to queries of tax payers, Madam Sheena ji...and I too leaving it here and not intrested to drag the things, but giving a suggestion to my frnd Mr.shiva....thats it. |  |

Guys plz maintain the decorum of this group plz don't involve in any type of unnecessary arguments. This group is for helping and passing necessary updates to each other. I request to each and every one plz do so. I am personally linked with this group since 15 months or so and this group has helped me and Sheena alot,

Phaneendra Babu

HI, Mr.Saif. I have seen your comments too and mam is trying to help you every time...and sorry from my side if any one got hurt....but what I meant is absolutely bare fact...!

Stay Home Stay Safe....!!!

Amit B

| Originally posted by : Phaneendra Babu | ||

|

Hello Mr Shiva, why unnecessarly u r quoting ur phone number and asking people to raise query personaly rather to post it in public domine and y u using insulting words with other professionals...pls don't do that...to be frank you have violated clause 5&6 of part 1 of Ist shedule to the CA act, 1949.Better don't reapeat it and no need to mention ur office address and phone number while u are addressing the queries of users/taxpayer. BTW I am a practicing advocate in high court of both telangana and Andhra Pradesh and Holding AOR with the prestigious high courts...so hope u understand me well....better not to repeat again. |  |

You are right sir. Unnecessarily copy posting same replies again and again is nothing but hijacking the forum and is nothing but ambush marketing. If a person truly wants to help or resolve queries of users / tax payers beyond giving replies in the public forum, he should simply say that users / tax payers can leave a direct message to seek his contact details. This way leaves a forum for a healthy discussion.

The reason for hold on your Income Tax Refund by Risk Management System Process (based on certain risk parameters in the system) may be as under-

1. Any Income Tax Demand is outstanding against you for any earlier assessment year/s & you have not submitted the response. In case of non-response/wrong response, refund will be adjusted u/s.245 to that extent

2. You have submitted Bank Account details for Refund, which is common in one or more ITR/s filed by another Tax Payer/s. e.g. You are joint account holder in the bank along with your son & wife. All of you 3 persons have submitted same bank account for getting refund. However the fact is not known to Income Tax Department’s system. Tax department want to make sure that the correct bank account details have submitted for refund or someone wrongly (intentionally or unintentionally) fed another bank account details.

Complete article can be read in the attached file

Hello All,

I strongly believe that Mr. SivaSir did correct at this point of time because you people are not able to explain clearly through messages at this point of time as we need to submit response on or before 15 days,As we are not aware of all your sections and provisions,

Mr.Siva Sir did the correct thing by giving his phone number at this point of time Although should not advertise but he did correct thing at this moment.

Without knowing anyone's knowledge experience and skills do not comment on people.

And main thing is Please try to help us don't argue among yourselves.

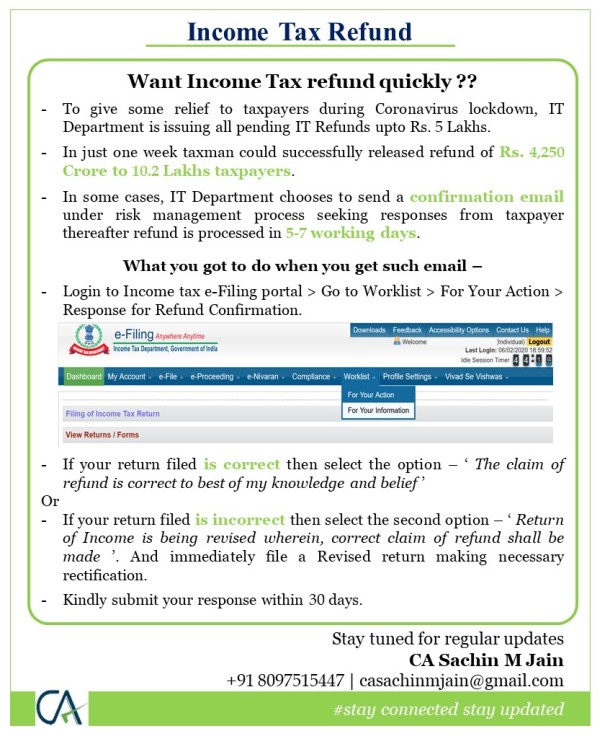

When you have received the email from department of Income tax risk management process, then you can follow the information in the attached image.

Regards

CA Sachin M Jain

8097515447 casachinmjain @ gmail.com

Hi All,

Good news,my return got processed and received a mail confirmation.Still I have not received any refund but I expect it to receive in one week.

Thank you very much Mr.Siva Sir for your guidance.

eswara rao n

Thank you Mr.Siva ,Me too had received refund.

Hope everyone had received their refunds.

Ur most welcome Mr.Karan and Mr.Eswar,

Hi All,

I am sorry for dropping my contact details in this Forum and now am leaving this forum.

Definitely few people are benefitted because of me.

Thank you

CA Siva.A

Leave a Reply

Your are not logged in . Please login to post replies

Click here to Login / Register

Recent Threads

- Free GST Reconciliation Tool in Google Sheets R

- NRI return after due date refund case

- TDS u/s 194J - training honorarium

- WHERE TO REGISTER UNDER PTRC AND PTEC ACTS ?

- Key Corporate Compliance Requirements for Private

- Gst Non Filling Return Notice

- GSTR 2B ( MULTIPLE MONTHS )

- Eway bill generation for export material.

- International Tax clarification UK.

- E way bill expired penalty

Related Threads

CAclubindia

CAclubindia