CA Job

512 Points

Joined March 2007

Dear Raj

Very sorry for a late reply.

1. a. Yes, from the fact, it is definitely an advance. I hope you had not raised the invoice for the amount received till 31.03.2014 and the revenue was recongnised only in April 2014 as per AS-9. If so, it is an advance from customer according the accrual system of accounting.

1.b. Yes, there is an option to mention in the ITR the system of accounting followed by the assessee under OI (Other information) schedule of ITR. Please note that this item can be optionally filled in case you are not liable to tax audit under Sec.44AB of thr Income Tax Act, 1961. And, if you are liable to get the books audited, you will have to compulsorily fill these details in the said schedule along with other information sought therein.

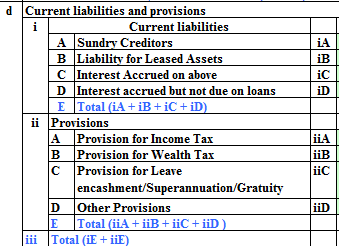

1.c. Your "Advance from Customers" can be shown as a Current Liability in the Balance Sheet Schedule of the ITR. Are you maintaining accounts for your business? If so, it will be there in the Balance Sheet you have prepared (there also, it should be appearing either as a credit balance in the Sundry Debtor (or equivalant A/c) or as a Current Liabilites named "Customer Advance"( or any equivalant A/c) and the said Balance Sheet schedule of the ITR has to be filled using the information from the one prepared by you.

1.d. Once you mention the customer advance as above, it will imply that you will be booking the revenue in any of the subsequent financial years, which in your case will be FY 2014-15 (AY 2015-16). This need not be specifically mentioned otherwise.

2. Gift - If it an exemption case, you can show it under Exempt Income (EI Schedule) towards the end of ITR-4. Even though this schedule does not affect your income tax computation as such, ideally all your exempt income should be disclosed here so as to avoid any questions in future.

There is no specific need to show the amount Gifted in the ITR of the person who is gifting you. The amount gifted will however, be reflected in his Balance Sheet in the Cash A/c and Drawings A/c (if he is a person engaged in a business keeping accounts) and/or in the cash flow statement of that individual. Again, if the person gifting you the sum has debited his Profit and Loss account (this is applicable in case she/he is a business person maintaining accounts), then it will be disallowed in her/his return of income being in the nature of personal expenditure.

However, kindly note that in certain cases, like transfer of asset between spouses, income earned from the investments made from the cash so gifted will be clubbed with income of the spouse who has gifted.

I am sorry if the whole answer seems too comlicated in any way. Please do ask if anything is not clear.

Regards

Ajay

CAclubindia

CAclubindia