New Delhi: Concerned that scores of initial public offerings (IPOs) that hit the market of late appear to have been overpriced, the Institute of Chartered Accountants of India (ICAI) is considering recommending a formula for the companies to compensate their shareholders by doling out fresh shares. The ICAI might take up the matter with the finance ministry and Securities and Exchange Board of India, sources privy to the development said.

Although there are doubts over whether the country’s accounting standard setter would go beyond its ambit by making such a potentially controversial proposal, it has already embarked on an exercise to analyse the pricing of IPOs in the last couple of years, these sources said.

The idea is to determine the monthly average of a share price and if that is found to be significantly below the initial public offer price, the ICAI would ask the market regulator if it could force, the companies to compensate its existing shareholders by issuing more shares.

The development has surprised many analysts as the ICAI, which is primarily an accounting regulator, has taken up the study on a suo motu basis.

“We are surprised that ICAI is looking into this matter. It's also not clear what issues they are trying to address. While overpricing may be a concern, there are no controls over it and such matters should be left to market forces,” said Sarabjeet Kaur Nangra, vice-president, research, Angel Broking.

When contacted, ICAI president, G Ramaswamy confirmed the development but declined to divulge any specific details either of the study or the proposed recommendations. “We are doing some research on the matter following which we would send our recommendations to Sebi,” Ramaswamy said.

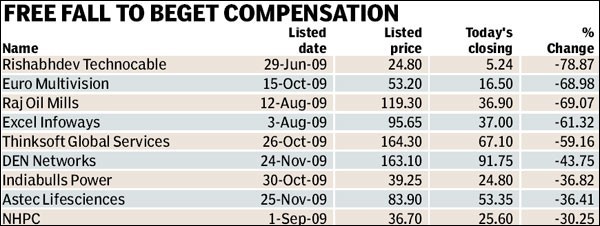

Firms that came out with IPOs in the last two years and whose share prices are currently trading far below their market price includes state-owned NHPC Ltd, Indiabulls Power Ltd, Euro Multivision Ltd, Astec Lifesciences Ltd, among others (see table).

The ICAI feels that overpricing of share issues discourages ordinary investors from the market, thereby bringing down the overall sentiment. Promoters typically overprice issues since they are unwilling to part with a higher stake in the company. The ICAI is of the view that although it has no role in regulating the markets, certain safeguards would need to be put in place regarding IPO pricing in the interest of the investors.

Analysts, however, doubt its efficacy. Jagannadham Thunuguntla, head, research, at SMC Global, said that while there are instances of overpricing of shares, it might be difficult to regulate the free pricing mechanism. “If the share price is too high, then it should be left to the market forces to determine the right price. More regulations would only lead to more complexities, hence such moves are best avoided,” he said. Thunuguntla said that a better approach would be to allow companies revise their share prices depending on the market demand. That is, if the demand is low, then a downward revision should be possible, without any limits. “Currently, if the issue does not get sufficient subscriptttion, then the merchant banker and the promoters can lower their issue price up to 20%. However, this is different from the prevalent norm in other countries where share price revision can be done without any limit,” he said.

In the history of public issues, software giant Google is said to have come up with the most innovative one. The company's merchant banker Morgan Stanley had decided to auction the share price. “This shows that various innovative attempts can be made for an IPO. In that connection, the government should not impose any restrictions,” another broker said.

Apart from the issue of overpricing, the ICAI is also looking at ways to prevent derivatives being used for speculative purposes. “Derivatives are used for hedging. However, it is being increasingly used for speculation. For this purpose, we want to suggest that more disclosure be made for the person investing in derivatives,” the source added.

CAclubindia

CAclubindia