Hi Team,

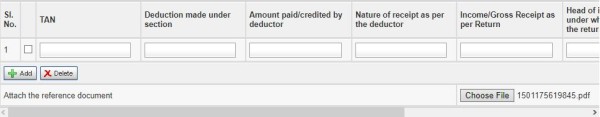

I had invested an additional INR 50000 in my NPS. By mistake in my Form 16 it was shown as Employee Contribution to NPS u/s 80 CCD(1) instead of 80CCD(1B). Now CPC sent me a notice u/s 143(1)(a) proposing to add INR 50000 to my total income. During submission of return I claimed this return u/s 80CCD(1B). When I selected "Disagree to the Addition" portal asked me the reason for deduction and displayed the following fields to fill up-

a. TAN: (Should it be my Employer's TAN?)

b. Deduction Made under section

c. Amount paid/credited by Deductor

d. Nature of receipt as per Deductor

e. Income/ Gross Receipt as per Return

f. Head of Income/ Schedule under which reported in the Return

g. Reason: (In my case should I select Deductions claimed in the return but not in Form 16?)

h. Justification/ Remarks (I understand I have to explain the details in here)

I have no idea about most of these fields. Can you please help me out here? Please note I am a salaried employee in a private organization and only other income is bank interest.

Regards

Ranajoy

CAclubindia

CAclubindia