Creator: TheProTalks

2325 Points

Joined January 2016

Yes, you will be allowed ITC on the taxes paid on goods which are retuned back to you, Have a look at this:

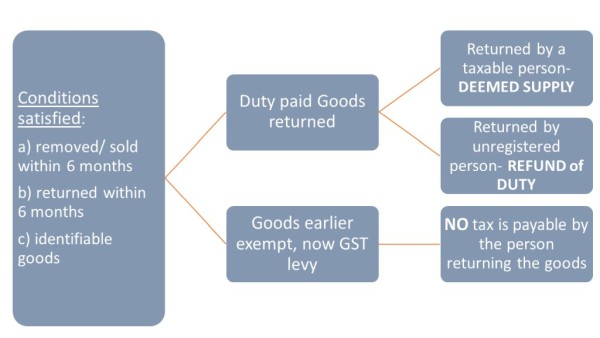

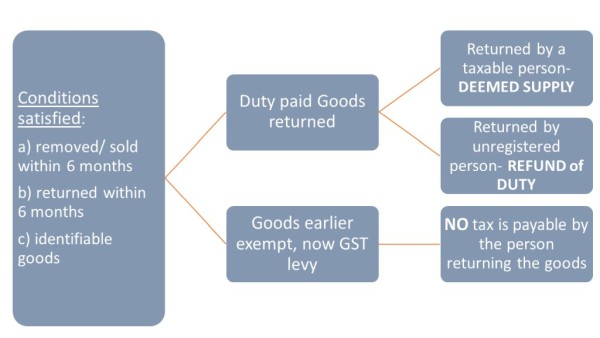

"If the

- goods were removed/sold within 6 months prior to the appointed day

- returned within 6 months from the appointed day, and

- the proper officer can satisfactorily identify the goods,

then the tax will be calculated as follows:

Duty paid goods returned by a registered taxpayer will be treated as ‘Deemed Supply’ and tax has to be paid on this by the person returning the goods. This is because the goods were sold before GST, allowing the buyer to claim input tax credit on the tax paid while discharging output tax liability, or to carry forward the input tax credit under GST. The seller, however, will not have been allowed input tax credits in the old regime.

When such goods are returned, GST will be discharged by the person returning the goods. The tax paid will be allowed as input tax credit to the original seller of such goods thus eliminating loss.

Thus the original seller being you will be allowed to take credit, please note that persons under Composition scheme also come under the purview of Registered persons

CAclubindia

CAclubindia