Menu

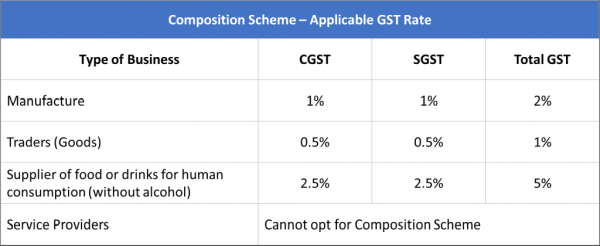

GST rate of trading business under composition scheme

please tell me rate of composition scheme

Replies (8)

Recent Threads

- Can I set off equity losses(both short term loss a

- Input tax credit on rent to rent

- Family Pension Army

- Waste Management services

- Seeking Clarity: New Transport Allowance Limits (D

- Query regarding Consolidated Gift Deed for Bank Tr

- TDS u/s194IB - Joint Ownership

- Free GST Reconciliation Tool in Google Sheets R

- NRI return after due date refund case

- TDS u/s 194J - training honorarium

Related Threads

CAclubindia

CAclubindia