Dear All,

We have valid GSTIN and we have been exporting in pre GST regime.

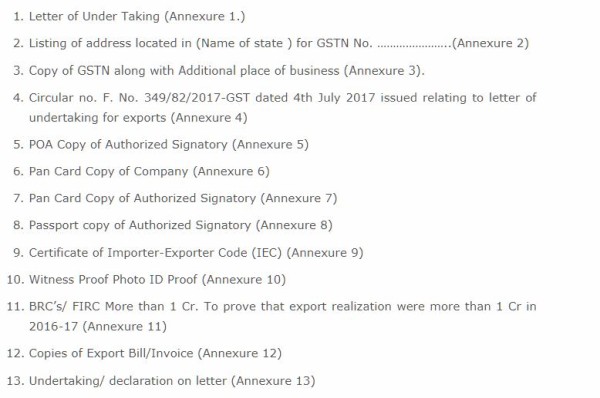

Our doubt is that Can we Export now if we,dont have a Letter of Undertaking and whether we have to pay IGST on our exports?

If so what tax rate we have to pay? Kindly mention the procedure of refund the IGST paid? how long it take to refund?

Expecting your views.

CAclubindia

CAclubindia