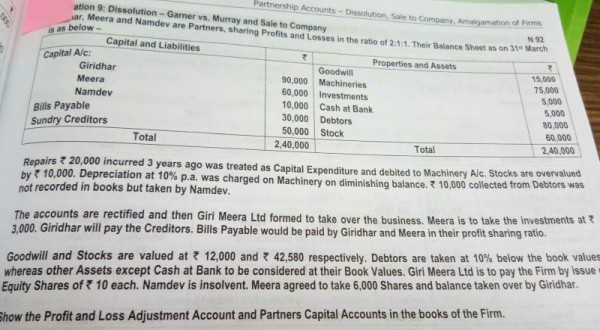

Hi. Can someone please help me with this sum. I get it upto the repair expense that should be taken to P&L i.e., Rs.14,580/-. However, what should be the carrying value of the machinery taken over? Thanks in advance.

Attached File : 2752777 20190328190533 advanced accounts.jpg downloaded: 129 times

CAclubindia

CAclubindia