Will there be a problem if i had more balance in bank at the end of financial year than income earned in previous year?

For example

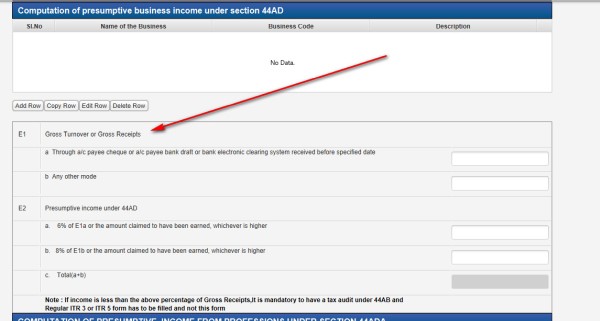

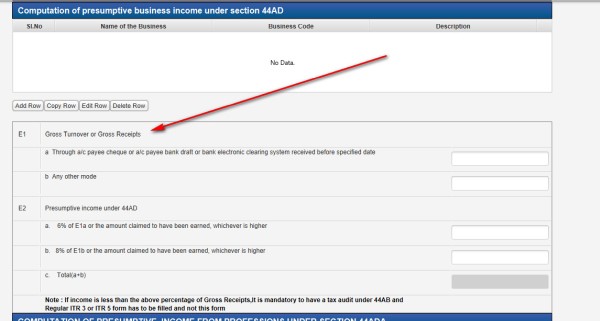

gross turnover E1(a) = 400000

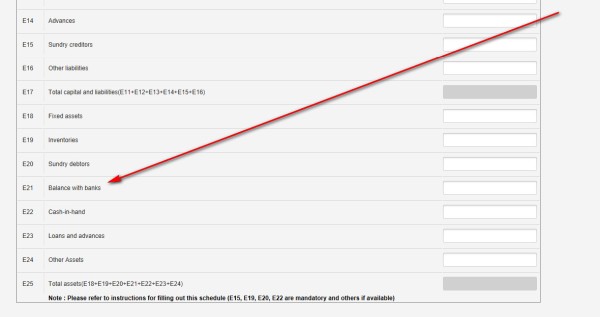

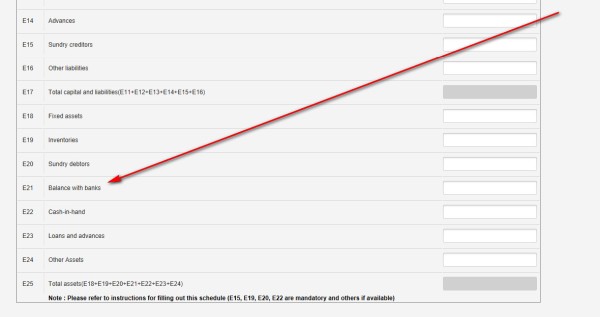

balance in bank E21 = 700000

Will there be a problem if i had more balance in bank at the end of financial year than income earned in previous year?

For example

gross turnover E1(a) = 400000

balance in bank E21 = 700000