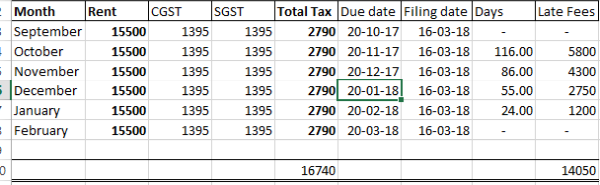

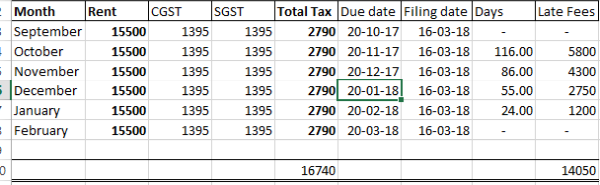

Hi, I am trying to file GSTR-3B for the months Sept 2017 -Feb 2018 , but the late fee liability ( @ 50/day) exceeds the amount of

tax payable. Is the following calculation for late fee correct?

.

.

Thanks in advance

Hi, I am trying to file GSTR-3B for the months Sept 2017 -Feb 2018 , but the late fee liability ( @ 50/day) exceeds the amount of

tax payable. Is the following calculation for late fee correct?

.

.

Thanks in advance