Tax Consultation (US and India)

2970 Points

Joined September 2011

Timber sale attracts TCS @ 2.5%

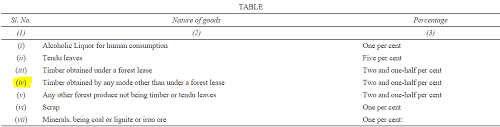

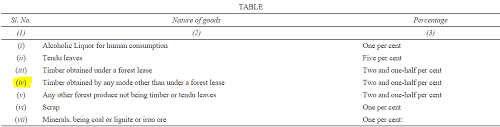

S.206C(1) Every person, being a seller shall, at the time of debiting of the amount payable by the buyer to the account of the buyer or at the time of receipt of such amount from the said buyer in cash or by the issue of a cheque or draft or by any other mode, whichever is earlier, collect from the buyer of any goods of the nature specified in column (2) of the Table below, a sum equal to the percentage, specified in the corresponding entry in column (3) of the said Table, of such amount as income-tax:

271CA. (1) If any person fails to collect the whole or any part of the tax as required by or under the provisions of Chapter XVII-BB, then, such person shall be liable to pay, by way of penalty, a sum equal to the amount of tax which such person failed to collect as aforesaid.

S.206C(7) Without prejudice to the provisions of sub-section (6), if the person responsible for collecting tax does not collect the tax or after collecting the tax fails to pay it as required under this section, he shall be liable to pay simple interest at the rate of one per cent per month or part thereof on the amount of such tax from the date on which such tax was collectible to the date on which the tax was actually paid and such interest shall be paid before furnishing the quarterly statement for each quarter in accordance with the provisions of sub-section (3):

Provided that in case any person, other than a person referred to in sub-section (1D), responsible for collecting tax in accordance with the provisions of this section, fails to collect the whole or any part of the tax on the amount received from a buyer or licensee or lessee or on the amount debited to the account of the buyer or licensee or lessee but is not deemed to be an assessee in default under the first proviso of sub-section (6A), the interest shall be payable from the date on which such tax was collectible to the date of furnishing of return of income by such buyer or licensee or lessee.

(8) Where the tax has not been paid as aforesaid, after it is collected, the amount of the tax together with the amount of simple interest thereon referred to in sub-section (7) shall be a charge upon all the assets of the person responsible for collecting tax.

CAclubindia

CAclubindia