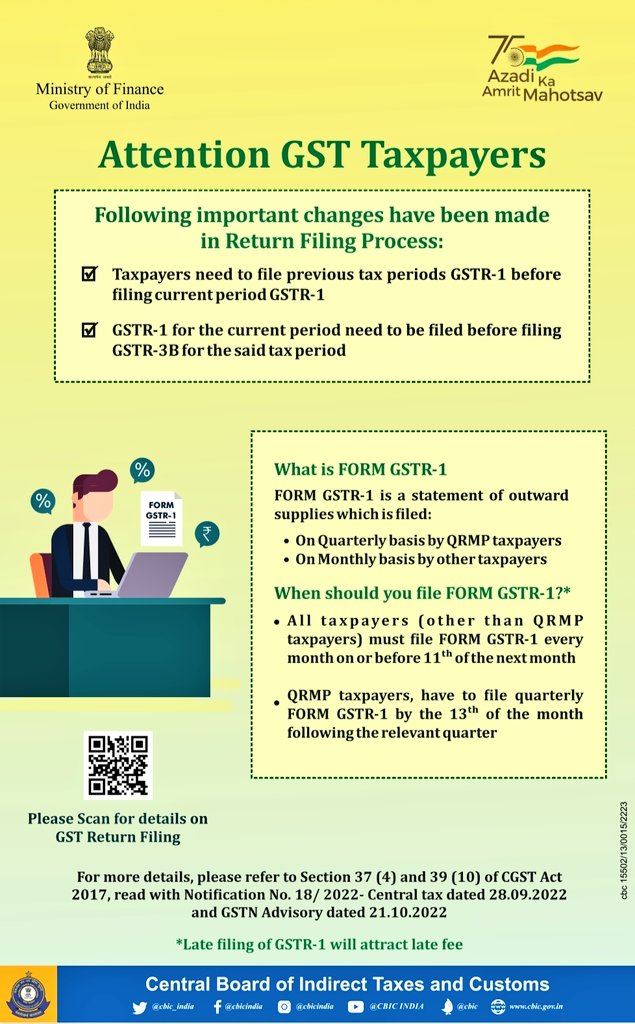

Following important changes have been made in Return Filing Process

- Taxpayers need to file previous tax periods GSTR-1 before filing current period GSTR-1

- GSTR-1 for the current period need to be filed before filing GSTR-3B for the said tax period

What is FORM GSTR-1?

FORM GSTR-1 is a statement of outward supplies which is filed:

- On Quarterly basis by QRMP taxpayers

- On Monthly basis by other taxpayers

When should you file FORM GSTR-1?*

- All taxpayers (other than QRMP taxpayers) must file FORM GSTR-1 every month on or before 11th of the next month

- QRMP taxpayers, have to file quarterly FORM GSTR-1 by the 13th of the month following the relevant quarter

For more details, please refer to Section 37 (4) and 39 (10) of CGST Act 2017, read with Notification No. 18/2022- Central tax dated September 28, 2022 and GSTN Advisory dated October 21, 2022

*Late filing of GSTR-1 will attract late fee

CAclubindia

CAclubindia