Professional Resource News

Vivek Tankha Calls for CA Protection Act, Flags Big Four Dominance in India's Audit Sector

13 February 2026 at 09:27Congress MP Vivek K. Tankha demands a CA Protection Act in Parliament, citing privacy concerns, agency scrutiny, and the growing dominance of Deloitte, PwC, EY and KPMG in India's audit sector.

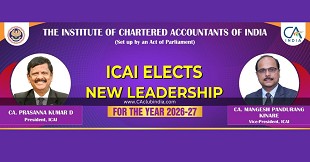

ICAI elects New Torchbearers for the year 2026-27

13 February 2026 at 09:06The 26th Council of ICAI has elected CA Prasanna Kumar D as its 74th President and CA Mangesh Pandurang Kinare as Vice-President for 2026-27.

ICAI's Global Ascent: President's Message Highlights Reforms, WOFA 2.0 and International Leadership

07 February 2026 at 07:53ICAI’s President reviews landmark initiatives including WOFA 2.0, ITEC programmes, audit reforms, sustainability reporting and ICAI's expanding global influence in the accounting profession.

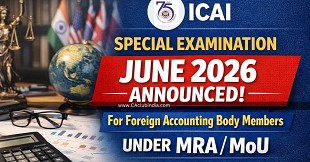

ICAI Special Examination June 2026 Announced for Foreign Accounting Body Members Under MRA/MoU

04 February 2026 at 08:25ICAI announces Special Examination for members of foreign accounting bodies under MRA/MoU. Exams from 15-19 June 2026 in Noida. Apply by 16 February 2026.

ICAI organises GES-CA 2026 to Transform Commerce Education into Future Leadership

20 January 2026 at 06:55ICAI hosted GES-CA 2026 in New Delhi with participation from 24 States and 2 UTs, launching the ICAI Model Curriculum and signing MoUs with 15 universities to strengthen commerce and accountancy education.

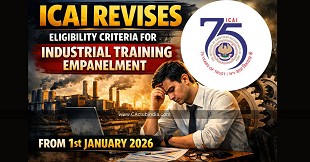

ICAI Revises Eligibility Criteria for Industrial Training Empanelment From 1st January 2026

13 January 2026 at 07:07ICAI has revised eligibility criteria for empanelment of organisations to impart Industrial Training, effective January 1, 2026, under Regulation 51(2)(b).

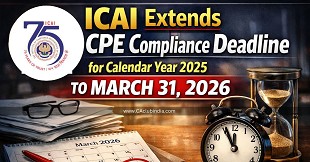

ICAI Extends CPE Compliance Deadline for Calendar Year 2025 to March 31, 2026

12 January 2026 at 07:01ICAI extends CPE hours compliance deadline for Calendar Year 2025 to March 31, 2026. Relief for CAs as ULA filing date also extended; revised applicability of consequential provisions announced.

New Year Message from ICAI President: India's Economic Momentum, CA Reforms & Global Expansion Plans

05 January 2026 at 09:08ICAI President outlines India’s economic rise, revised Code of Ethics, global networking norms, startup ecosystem and future roadmap for CA firms in 2026.

ICAI Conducts Convocation Across 15 Locations; Inducts Nearly 20,000 New CAs

31 December 2025 at 06:45ICAI held its convocation across 15 locations on December 30, 2025, inducting nearly 20,000 newly qualified Chartered Accountants and welcoming them into the profession.

ICAI Clears Advertising for CA Firms, Approves Global Networking Rules; UDIN Crosses 10 Crore

15 December 2025 at 09:27ICAI announces landmark reforms allowing advertising by CA firms, approves global networking guidelines and reports UDIN crossing 10 crore.

Popular News

- Exceptions for Cash Payments Above Rs 10,000 under Rule 26 of Draft IT Rules 2026

- ICAI Introduces UDIN Ceiling & Field-Level Validation for Section 44AB Tax Audits from 1st April 2026

- Provident Fund Contributions Above Threshold? Here's How Rule 277 Taxes Interest

- Draft Form 124 Proposes Mandatory Disclosure of Relationship With Landlord for HRA Claims

- ICAI: UDIN Validation Now Based on Five Parameters Including PAN

Trending Online Classes

-

DT & Audit (Exam Oriented Fastrack Batch) - For May 26 Exams and onwards Full English

CA Bhanwar Borana & CA Shubham Keswani

CA Bhanwar Borana & CA Shubham Keswani -

IDT LIVE Exam Oriented Batch | May 2026, Sept 2026 & Jan 2027

CA Arpita Tulsyan

CA Arpita Tulsyan

CAclubindia

CAclubindia