CAclubindia News

DGGI Arrests Online Gaming Owners for Rs 320 Crore GST Evasion

13 December 2025 at 06:50The DGGI Meerut Zone has arrested two online gaming company owners for allegedly evading Rs 320 crore in GST after collecting Rs 1,200 crore from players.

ICAI Releases Schedule for May 2026 CA Exams

12 December 2025 at 16:48ICAI releases CA May 2026 exam timetable. Know the dates for Foundation, Inter, Final, exam timings, fees, centres and online form window starting March 3.

GST Rationalisation Delivers Major Relief to Dairy, Food Processing & Agriculture Cooperatives

12 December 2025 at 06:47The Centre's GST rationalisation brings major relief to dairy, food processing, agriculture and rural cooperatives.

Gujarat High Court Orders IT Refund to Ex-Serviceman on Disability Pension

12 December 2025 at 06:47Gujarat High Court has ruled that disability pension is fully tax-exempt even for ex-servicemen who retire voluntarily.

CBDT Issues Over 44,000 Alerts for Undisclosed Crypto Transactions

12 December 2025 at 06:47CBDT issues over 44,000 notices for undisclosed crypto transactions as ED attaches Rs 4,189 crore. TDS collections on crypto double, revealing major compliance gaps.

Centre Tightens GST E-Way Bill Rules After CAG Highlights Technical Loopholes

11 December 2025 at 09:17Government acknowledges CAG-flagged deficiencies in the GST e-way bill system and outlines measures to stop multiple e-way bills, non-filer misuse and cancelled GSTIN issues.

GST Rates Reduced for Multiple Goods and Services: Centre Explains Rationale

11 December 2025 at 09:13GST rate reduction approved across sectors to simplify taxes and boost ease of doing business. Govt outlines consultations and impact analysis.

CBIC Confirms GST Rate Cut Benefits Reaching Consumers: Govt Issues Revised Pricing Orders

11 December 2025 at 09:13The Finance Ministry has confirmed that GST rate reduction benefits from September 2025 are being passed on to consumers.

GST Reforms Deliver Positive Impact: Collections Rise After New Two-Rate Structure

11 December 2025 at 07:01The Finance Ministry has highlighted the impact of major GST reforms approved in 2025, including a new two-rate structure, GSTAT rollout, rate cuts on essential goods, and NIL GST on lifesaving medicines.

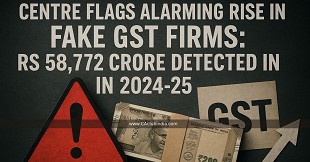

Centre Flags Alarming Rise in Fake GST Firms: Rs 58,772 Crore Detected in FY 2024-25

11 December 2025 at 07:00The Finance Ministry has reported a sharp rise in GST evasion through fake invoicing and sleeping modules, with over 24,000 cases detected in FY 2025-26 and significant revenue losses

Popular News

- GST Council Urged to Scrap Rs 7500 Threshold and Fix Single 5% Tax Across Hotels

- Budget 2026-27: Direct Tax Reforms for Ease of Living, Small Taxpayer Relief

- TDS/TCS Guidelines to Become Binding on Tax Authorities and Deductors from April 2026

- Income Tax Rules, 2026 Notified: Rule-Wise Comparison with Old IT Rules, 1962

- Draft Income Tax Rules, 2026 Released: Major Changes in Capital Gains, Perquisites and Non-Resident Taxation

Trending Online Classes

-

DT & Audit (Exam Oriented Fastrack Batch) - For May 26 Exams and onwards Full English

CA Bhanwar Borana & CA Shubham Keswani

CA Bhanwar Borana & CA Shubham Keswani -

IDT LIVE Exam Oriented Batch | May 2026, Sept 2026 & Jan 2027

CA Arpita Tulsyan

CA Arpita Tulsyan

CAclubindia

CAclubindia