CAclubindia News

Finance Ministry Sets Up Forum for Pension Regulatory Coordination and Development

27 August 2025 at 08:51The Finance Ministry has set up a Forum for Regulatory Coordination and Development of Pension Products to harmonize regulations, strengthen consumer protection and boost India’s pension market.

ICAI Convocation 2025: 13,737 Newly Qualified CAs Receive Membership Pan India

27 August 2025 at 08:42ICAI held convocation ceremonies across 15 centers in India, conferring membership to 13,737 newly qualified Chartered Accountants. The event celebrated the achievements of new CAs, marking a significant milestone in their professional journey.

CBIC Urges Public to Avoid Speculation on GST Rates Ahead of Council Meeting

27 August 2025 at 08:40CBIC cautions against premature speculation on GST rate changes. Official decisions to be announced after the GST Council meeting on September 3-4, 2025.

ICAI Releases CA Foundation, Intermediate & Final Admit Cards for September 2025 Exams

26 August 2025 at 10:23The Institute of Chartered Accountants of India (ICAI) has officially released the admit cards for the upcoming Chartered Accountancy (CA) Foundation, Intermediate & Final exams scheduled for September 2025.

Chartered Accountant and his Associate Booked for Rs 217 Crore GST Scam Using Forged Signatures

26 August 2025 at 09:44Navrangpura police have booked a chartered accountant and his associate in Ahmedabad for allegedly defrauding a businessman of Rs 217 crore through forged signatures and bogus GST transactions.

CBDT Panel Recommends Tougher Benami Law With Wider Data Access for IT Department

26 August 2025 at 09:38Centre may tighten Benami law with Aadhaar, property, and vehicle data access for tax officials, stricter rules for shell firms and dummy directors.

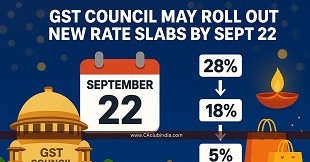

Centre Braces for Rs 40,000 Crore Revenue Loss as GST Overhaul Nears

26 August 2025 at 09:35Centre braces for Rs 40,000 crore revenue loss as GST reforms shift to two slabs of 5% and 18%.

Income Tax Raids NGOs Across 6 States, Uncover Rs 800 Crore CSR Fund Misuse

26 August 2025 at 09:21Income Tax raids on NGOs across 6 states expose Rs 800 crore CSR misuse and Rs 10,000 crore bogus remittances abroad; probe still underway.

GST Council May Roll Out New Rate Slabs by September 22, Ahead of Festive Season

26 August 2025 at 09:12GST Council may roll out new two-slab GST rates around September 22 to boost festive demand, with cuts likely after its September 3-4 meeting.

ITAT Patna Grants Tax Relief on Rs 4.5 Crore Property Sale Despite Filing Error

25 August 2025 at 09:10ITAT Patna grants major relief to taxpayer, allowing Rs 4.5 crore property sale exemption despite the wrong section being claimed. Tribunal rules substance over form, citing CBDT's 1955 circular.

Popular News

- Exceptions for Cash Payments Above Rs 10,000 under Rule 26 of Draft IT Rules 2026

- ICAI Introduces UDIN Ceiling & Field-Level Validation for Section 44AB Tax Audits from 1st April 2026

- Provident Fund Contributions Above Threshold? Here's How Rule 277 Taxes Interest

- ICAI: UDIN Validation Now Based on Five Parameters Including PAN

- Draft Form 124 Proposes Mandatory Disclosure of Relationship With Landlord for HRA Claims

Trending Online Classes

-

DT & Audit (Exam Oriented Fastrack Batch) - For May 26 Exams and onwards Full English

CA Bhanwar Borana & CA Shubham Keswani

CA Bhanwar Borana & CA Shubham Keswani -

IDT LIVE Exam Oriented Batch | May 2026, Sept 2026 & Jan 2027

CA Arpita Tulsyan

CA Arpita Tulsyan

CAclubindia

CAclubindia