CAclubindia News

Finance Ministry Assures Sufficiency of GST Compensation Cess Fund

06 January 2025 at 08:54The Finance Ministry has addressed concerns regarding the adequacy of the GST Compensation Cess Fund, emphasizing that there is no shortfall in meeting compensation and loan repayment obligations.

Ministry of Civil Aviation Denies Digi Yatra Data Sharing with Tax Authorities

06 January 2025 at 08:54The Ministry of Civil Aviation has strongly refuted claims that passenger data from the Digi Yatra app is being shared with Indian tax authorities.

Union Budget 2025: Tax Incentives for Fixed Deposits on the Table to Boost Middle-Class Savings

06 January 2025 at 08:54As the Union Budget 2025 approaches, Finance Minister Nirmala Sitharaman is actively engaging with representatives from the financial sector to consider key recommendations aimed at boosting middle-class savings.

CAG Invites Online Applications for Empanelment of CA Firms/LLPs for 2025-26

06 January 2025 at 08:54The Office of the Comptroller and Auditor General (CAG) of India has issued a public announcement inviting Chartered Accountant firms and LLPs to apply for empanelment for the financial year 2025-26.

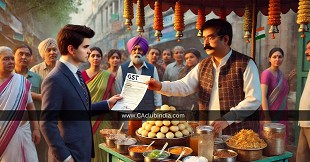

GST Notice Issued to Pani Puri Vendor Over Rs 40 Lakh Digital Transactions

04 January 2025 at 13:59In a surprising turn of events, a pani puri vendor has come under the scrutiny of the GST department after reportedly receiving payments amounting to Rs. 40 lakh annually.

Gujarat Records 19% Growth in GST Revenue in Q3 FY 2024-25

04 January 2025 at 09:01Gujarat has reported a 19% increase in revenue under the Goods and Services Tax (GST) during the third quarter (Q3) of the financial year 2024-25, as compared to the same period last year.

ICAI Submits Suggestions on Comprehensive Review of the IT Act 1961 and Pre-Budget Memorandum 2025

04 January 2025 at 08:58Explore ICAI's preliminary inputs on the Comprehensive Review of the Income-tax Act, 1961, discussed during a stakeholder consultation chaired by the Revenue Secretary on September 18, 2024

CBDT Issues Key Income Tax Exemptions for Credit Guarantee Entities and IFSC Units

04 January 2025 at 08:57The Central Board of Direct Taxes (CBDT) has issued three significant notifications under the Income-tax Act, 1961, aimed at tax relief and compliance facilitation, effective from January 1, 2025.

Online Popcorn and Movie Ticket Combo May Attract 12-18% GST

03 January 2025 at 09:03Consuming popcorn at a movie theatre could soon cost you more, depending on how it is served and bundled with movie tickets.

Income Tax Department to Update ITR Forms for Section 87A Tax Rebate Claims for FY 2023-24

03 January 2025 at 09:02The Income Tax Department has announced a major relief for resident individuals eligible to claim the Section 87A tax rebate for FY 2023-24 but were unable to do so earlier.

Popular News

- Exceptions for Cash Payments Above Rs 10,000 under Rule 26 of Draft IT Rules 2026

- ICAI Introduces UDIN Ceiling & Field-Level Validation for Section 44AB Tax Audits from 1st April 2026

- Provident Fund Contributions Above Threshold? Here's How Rule 277 Taxes Interest

- ICAI: UDIN Validation Now Based on Five Parameters Including PAN

- Draft Form 124 Proposes Mandatory Disclosure of Relationship With Landlord for HRA Claims

Trending Online Classes

-

DT & Audit (Exam Oriented Fastrack Batch) - For May 26 Exams and onwards Full English

CA Bhanwar Borana & CA Shubham Keswani

CA Bhanwar Borana & CA Shubham Keswani -

IDT LIVE Exam Oriented Batch | May 2026, Sept 2026 & Jan 2027

CA Arpita Tulsyan

CA Arpita Tulsyan

CAclubindia

CAclubindia