CAclubindia News

Taxpayers, CAs File Appeals Against IT Notices Over Section 87A Rebate Claims

05 April 2025 at 09:05The long-standing confusion surrounding Section 87A rebate claims has reared its head again. Despite revising their income tax returns (ITRs) in January 2025 as per the Bombay High Court's directive

GSTN Issues Advisory on Case Sensitivity in IRN Generation

05 April 2025 at 08:51In a move to enhance consistency and reduce duplication in e-invoicing, the Invoice Registration Portal (IRP) will treat invoice or document numbers as case-insensitive for the purpose of IRN generation, starting June 1, 2025.

CBDT Mandates PAN-Aadhaar Linking by Dec 31, 2025 for Pre-October 2024 Applicants

05 April 2025 at 08:50CBDT has issued a fresh notification mandating that individuals who were allotted a PAN based on their Aadhaar Enrolment ID before October 1, 2024, must update their Aadhaar number with the Income Tax Department by December 31, 2025.

ICAI Releases CA Final Eligibility, SPOM Criteria for September 2025 & January 2026 Exams

04 April 2025 at 16:14The Institute of Chartered Accountants of India (ICAI) has released important updates regarding the Chartered Accountants Final Examinations scheduled for September 2025 and January 2026

Income Tax Department Enables Rectification Applications for AY 2023-24 via E-Filing Portal

04 April 2025 at 08:52In a significant move to streamline the ITR rectification process, the Income Tax Department has enabled taxpayers to file rectification applications before an AO for up to AY 2023-24 (Financial Year 2022-23) through the e-filing portal.

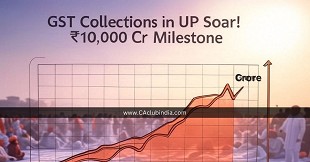

GST Collections in UP Reach Rs 10,000 Crore in March, Fueled by Maha Kumbh

04 April 2025 at 08:49Uttar Pradesh's Goods and Services Tax (GST) collections reached an impressive Rs 10,000 crore in March, marking an 11-month high, according to government data released on Tuesday. sive attenda

No Cut in Capital Expenditure, Claims FM Nirmala Sitharaman

04 April 2025 at 08:44On Tuesday, Finance Minister Nirmala Sitharaman firmly responded to former Finance Minister P Chidambaram's criticism regarding capital expenditure (capex), stating that there has been no reduction in the central government's capex.

CBDT Recovers Rs 92,400 Crore in Outstanding Tax for FY 2024-25

03 April 2025 at 08:48CBDT has successfully recovered ₹92,400 crore in outstanding tax liabilities in the ongoing financial year (2024-25) up to March 15, according to sources familiar with the matter.

DFS Secretary Leads Meeting on Revamping Central KYC Records and Addressing KYC Challenge

03 April 2025 at 08:34Secretary, DFS chaired a meeting at Manthan, DFS to discuss the revamp of the Central KYC Records Registry (CKYCR) and key issues related to KYC compliance with the objective of making life of citizen comfortable while availing Financial Services

No New 5% GST on Food Delivery Apps, Confirms Finance Ministry

03 April 2025 at 08:29In a major clarification, the central government has stated that it has no plans to impose a fresh 5% Goods and Services Tax (GST) without input tax credit on food delivery platforms such as Zomato and Swiggy.

Popular News

- Exceptions for Cash Payments Above Rs 10,000 under Rule 26 of Draft IT Rules 2026

- ICAI Introduces UDIN Ceiling & Field-Level Validation for Section 44AB Tax Audits from 1st April 2026

- Provident Fund Contributions Above Threshold? Here's How Rule 277 Taxes Interest

- ICAI: UDIN Validation Now Based on Five Parameters Including PAN

- Draft IT Rules 2026: No Refund, No Interest & Higher TDS for Inoperative PAN

Trending Online Classes

-

DT & Audit (Exam Oriented Fastrack Batch) - For May 26 Exams and onwards Full English

CA Bhanwar Borana & CA Shubham Keswani

CA Bhanwar Borana & CA Shubham Keswani -

IDT LIVE Exam Oriented Batch | May 2026, Sept 2026 & Jan 2027

CA Arpita Tulsyan

CA Arpita Tulsyan

CAclubindia

CAclubindia