Income Tax News

IT Department conducts searches on a popular chain of educational institutes in Maharashtra

25 March 2022 at 08:36The Income Tax Department carried out a search and seizure operation on 14.03.2022 on a popular chain of educational institutes, running several schools and colleges at multiple locations in India and abroad.

CBDT issues refunds to more than 2.26 crore taxpayers from 1st April 2021 to 20th March 2022

24 March 2022 at 12:31CBDT issues refunds of over Rs. 1,93,720 crore to more than 2.26 crore taxpayers from 1st April 2021 to 20th March 2022.

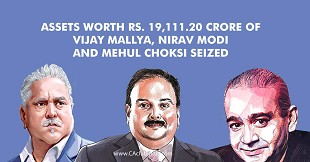

Assets worth Rs 19,111.20 crore of Vijay Mallya, Nirav Modi and Mehul Choksi seized

23 March 2022 at 08:57Cases pertaining to Vijay Mallya, Nirav Modi and Mehul Choksi who have defrauded Public Sector banks by siphoning off the funds through their companies which resulted in total loss of Rs. 22,585.83 crore to the public sector banks.

IT Department conducts searches in a prominent Real Estate Group of North India

22 March 2022 at 16:36Income Tax Department conducts searches in a prominent Real Estate Group of North India

IT Department conducts searches on a Pune & Thane based unicorn start-up group

21 March 2022 at 08:39Income Tax Department conducted a Search & Seizure operation on a Pune & Thane based unicorn start-up group, primarily engaged in the business of wholesale and retail of construction material

CBDT condones delay in filing of Form 10-IC for AY 2020-21

18 March 2022 at 07:50Condonation of delay under section 119(2)(b) of the Income-tax Act, 1961 in filing of Form 10-IC for Assessment Year 2020-21

CBDT provides relaxation from the requirement of electronic filing of application in Form No.3CF

18 March 2022 at 07:50Relaxation from the requirement of electronic filing of application in Form No.3CF for seeking approval under section 35(1)(ii)/(iia)/(iii) of the Income-tax Act,1961 (the Act)

Net Direct Tax collections surge 48.4% at Rs 13.63 lakh crore for FY 2021-22

18 March 2022 at 07:50The figures of Direct Tax collections for the Financial Year 2021-22, as on 16.03.2022 show that net collections are at Rs. 13,63,038.3 crore compared to Rs. 9,18,430.5 crore over the corresponding period of the preceding financial year i.e FY 2020-21

Income Tax Department conducts search operation on a cable operator of Mumbai

18 March 2022 at 07:50Income Tax Department carried out a search operation on 08.03.2022 on a cable operator of Mumbai, a State Govt employee and the businesses related to him

CBDT releases circular related to TDS and Income Tax Deduction from Salaries during FY 2021-22

17 March 2022 at 08:47Circular No. 4/2022: Deduction of Tax at Source - Income-tax Deduction from Salaries under section 192 of the Income-tax Act, 1961

Popular News

- ICAI Introduces UDIN Ceiling & Field-Level Validation for Section 44AB Tax Audits from 1st April 2026

- Draft Form 124 Proposes Mandatory Disclosure of Relationship With Landlord for HRA Claims

- ICAI: UDIN Validation Now Based on Five Parameters Including PAN

- MCA Launches Companies Compliance Facilitation Scheme 2026 with Major Relief on Late Filing Fees

- New Draft Form Introduced for Provisional Registration Under Income Tax Act, 2025

Trending Online Classes

-

DT & Audit (Exam Oriented Fastrack Batch) - For May 26 Exams and onwards Full English

CA Bhanwar Borana & CA Shubham Keswani

CA Bhanwar Borana & CA Shubham Keswani -

IDT LIVE Exam Oriented Batch | May 2026, Sept 2026 & Jan 2027

CA Arpita Tulsyan

CA Arpita Tulsyan

CAclubindia

CAclubindia