Which ITR form for individual sole proprietorship AY 2015-2016

Dear Sir/Madam,

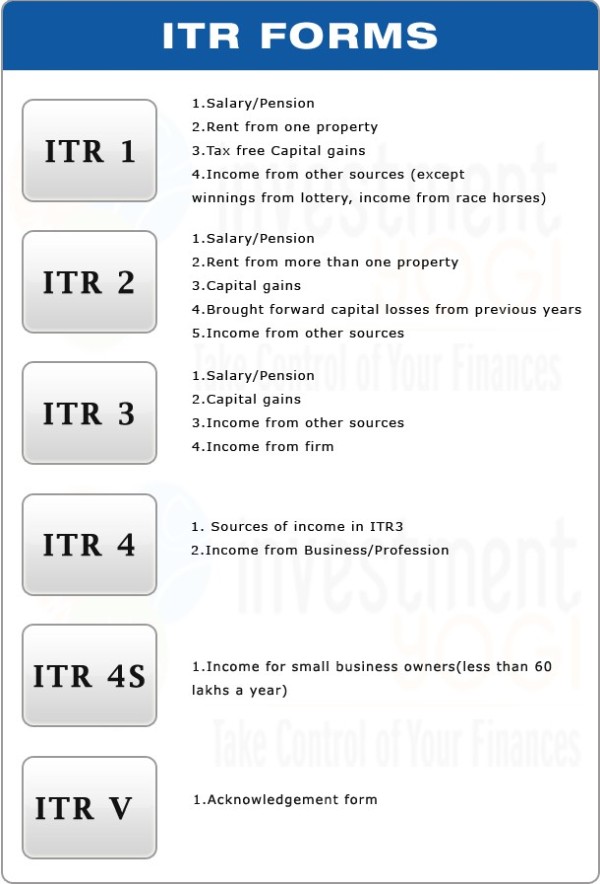

I wish to confirm that for a person running an import/export software business and profit is about 7 lakhs under individual name ITR 4 only applies ?

Am I correct ?

Thanks a lot.

Regards

Shanthi

CAclubindia

CAclubindia